23 December 2005

Personal Thoughts - Dofasco Inc.

Of course, what they both see, and probably others, is QCM in Dofasco's pocket. Given the ore reserves and production, this will more than give a solid return on their bids, with the price of ore increasing for 2006.

However, Dofasco has been generous in their compensation plan with their employees...and keep in mind, anyone that puts out $5B for an investment, strategic or not, wants a return on their investment. Will Arcelor or TK get their return on the ore assets? I think so. But, you can't help but think that after Dofasco's $150 million charge against Q1 2005 for employees' compensation (refer to 2004 annual report), that after due diligence of the books, any suitor won't come in looking to make some changes to extract value for their shareholders.

It may be a year down the road, but I expect that changes may come for any suitor to maximize the return on their investment...with pressure from boards to provide 12-15% return, somehow Dofasco Inc. has to pony up $600-$750 million in gross earnings to contribute to the suitor's bottomline.

With the gap in steel prices and commodities closing, the only place left to squeeze value is in the operating costs.

Arcelor Bids Again....$63 is the number

ARCELOR ENHANCES OFFER TO ACQUIRE DOFASCO INC.

23 December 2005 Companynews

(c) Copyright 2005 CompanynewsGroup. All rights reserved.

PRESS RELEASE Arcelor enhances offer to acquire Dofasco Inc. Luxembourg/Toronto - December 23rd, 2005 - Arcelor S.A. announces its intention to make an enhanced all cash offer to acquire all of the outstanding common shares of Canadian steelmaker Dofasco Inc. (TSX: DFS) at C$63.00 per share. Arcelor expects that the Board of Directors of Dofasco will recognize that this offer is superior to ThyssenKrupp's offer. Arcelor is open to approaches by Dofasco's Board of Directors and / or another party to finalize the acquisition at this attractive price level for the Dofasco Shareholders. Guy Dollé, Chief Executive Officer of Arcelor, reiterated that "Expansion into North America is a key strategic objective for Arcelor. We believe that Arcelor is an excellent partner for Dofasco. As a partner of the Arcelor group, Dofasco will become a stronger, more competitive steel producer on the North American steel market." Mr. Dollé also underlined that Dofasco's highly regarded corporate values with respect to its relations with employees, and its legacy of active community engagement, are principles that Arcelor shares and will continue to support. Full details of the offer will be included in the formal take-over bid and circular documents which Arcelor expects to mail to Dofasco shareholders in the coming days.

22 December 2005

2005 S&P Performance and 2006 Info

20 December 2005

Looking for a Bank Stock? Try Laurentian

19 December 2005

US Steel Value vs Dofasco

"Analysts say ThyssenKrupp's offer already is expensive, representing a 40% premium to Dofasco's share price before Arcelor launched its bid in November. In a recent report, Morgan Stanley estimated ThyssenKrupp's offer values Dofasco's steel capacity at about $1,000 a ton, while U.S. Steel Corp. trades at about $350 a ton."

As I had blogged earlier in the month, US Steel won't command the same price as Dofasco. With the difference in value, and other factors, I would like to see USX improve their results. So does Citigroup. Other agencies are soon to follow.

Comment Question - Nortel Stock or Options?

Here is a good article that gives the general concepts for others considering options trading;

http://www.investopedia.com/articles/optioninvestor/03/073003.asp

Because of the volatility with the company right now, I have no doubt that the stock price would rise over the next 6 months for a substantial gain (beats indices). However, with all the management changes going on right now with Nortel, and other factors (growth, etc.), I think that the options for Nortel are risky right now...what I think is, there are more variables affecting the volatility than what can be accurately predicted.

That being said, sure, if you had some money you wanted to risk, and after understanding all the volatility behind the premium, then yes, I would do it. The one thing that would hold me up personally right now, is that I don't have a portfolio diverse enough to take the risk. Its also hard to answer your question without understanding more of the contracts you are considering.

To put in perspective, I would option HP before Nortel, based on the what I see. With increased volatility, comes increased risk and reward.

Here is a blog I read every day, Phil's World, which gives you a good handle on what all is involved with options trading. Read about his risks and rewards.

18 December 2005

Update - Miscellaneous

- RIM is still having its legal problems. Earlier this month, I figured a target of $62 for RIM. With the courts ruling against RIM, I still maintain it will go lower ($1 billion settlement to NTP, and expensive licensing arrangement). Stay tuned.

- Stelco, well, what can be said about it. Shareholder value has been all but wiped out. With the new shares under the restructuring plan having a value of $5.50, steel prices softening in Q1, I don't expect big things from them.

- Dofasco hit the $64 mark...might be a good idea to take it now. Even though Arcelor is going to act or react sometime this year, going into the holidays and into the new year, I don't think there will be any surprises.

- Sony is still on my watch list - I can't help but think that it will be a bargain some time in the first 6 months of 2006.

- Nortel is being sluggish. No surprise there with the changes in management.

- Vincor, having defeated the Constellation takeover, still feels that Constellation's bid was oppurtunistic - I agree. Again, we'll see what happens with next quarter results.

- Laurentian Bank has been on my watch list for the last 3 months - steady gains over the last 4 weeks make it a good buy.

Personal Thoughts - GM

Seems that GM is going in spurts these last 4 quarters. My thoughts are that the new models might actually spurn some spending in the new year, within the first 6 months anyways. With Kerkorian getting his seat on the board, and a mediocre restructuring plan, I think its possible to get some value out of the stock for the next 6 months.

The big thing missing in GM's plan, is exciting models. Keep in mind GM, that stylish, affordable, reliable cars are what the public needs. GM is not in a position to challenge DCX with designs like the 300. The formula has worked well for Toyota and Honda, both which started out with the affordable/reliable route first, before they moved into styling and going after market segments.

GM, remember the KISS method - Keep it Simple, Stupid. I'll revisit GM down the road, pending developments with Delphi too.

Well-Rested and Ready to Go

Stay tuned!

11 December 2005

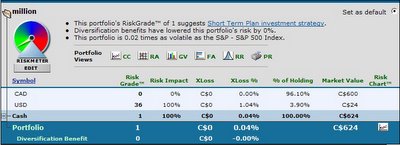

Updated Portfolio - 9 Dec 05

$624...another $999,376 to go.

$624...another $999,376 to go.

10 December 2005

Inside Scoop on What Happened with Dofasco

Dofasco board shows steel in Thyssen deal: Behind the scenes, board and advisors forced higher offer

Sandra Rubin

Financial Post 7 December 2005

National Post National FP9(c) 2005 National Post . All Rights Reserved.

We were interested to see reports last week that Dofasco CEO Don Pether took it on the chin from some hedge funds for signing a $61.50 a share friendly deal with ThyssenKrupp instead of soliciting higher bids. Mr. Pether's tongue must have been bleeding. What they didn't know, and he couldn't say, is that Dofasco's management and financial advisers had personally contacted all the usual steel industry suspects to ask them if they wanted to mount a bid -- and got Thyssen to up its own bid at least twice and cut the break fee in half before signing a deal.

The whole saga started May 27 with a $43 a share joint offer from the Luxembourg-based steelmaker Arcelor and U.S. steelmaker Nucor Corp.

People thought the sale was going to go ahead then. In fact, we hear Jon Levin, who was working with Joan Weppler, Dofasco's vice-president and general counsel, and a Fasken Martineau team that included Wally Palmer and Sean Stevens, actually cancelled his summer vacation. (For those of you who don't have your list handy, that's No. 17 on the Top 50 Ways to Make Yourself Popular at Home. It's a Category 33.6 offence, punishable by jewelry.)

When the $43 offer landed, Dofasco retained a team led by Peter Buzzi at RBC Dominion Securities to provide a fairness opinion and its view can be distilled thus: unfair. A short time later, the Arcelor group, which was being advised by a team at Ogilvy Renault headed by Marc Lacourciere and Terry Dobbin, upped its bid to $46 in cash plus a share of Quebec Cartier Mines.

Things really only heated up Nov. 10 when Arcelor and Nucor (being advised on the financial side by Jim Kofman and David Bain of UBS Securities) sent Dofasco a letter saying they were willing to pay $52 a share if the bid was hostile, and $55 for a friendly bid that allowed them to do due diligence.

Oh, and at that point Arcelor threatened to circumvent the board and go directly to shareholders. The board thought about it over the weekend and met Monday, Nov. 14 to discuss the situation. They sent the Arcelor group a return letter, saying the latest offer didn't appear to fully value the company. They suggested the group meet with Dofasco's financial advisers.

Nov. 16, Dofasco's special committee met and asked Mr. Pether to contact ThyssenKrupp to see if the German company would be interested in making an offer.

The two companies had been looking at doing some joint ventures together -- and Mr. Pether had had a rather interesting conversation a few months earlier with Ekkehard Schulz, ThyssenKrupp's executive chairman. It went something like this.

Dr. Schultz: "You know, Don, I've been thinking. We've been looking at doing business for some time. I like you. I like your company. And I think we'd want to make a bid for Dofasco if someone put you in play by making a hostile run at you -- assuming, of course, you think that's appropriate."

Mr. Pether: "Ekkehard, if we're on the wrong end of a hostile, there's no one I'd rather have as my white knight." Maybe Dr. Schulz consulted Madame Imakamyownlucka, the noted public-company psychic. Maybe it was just fortuitous. All we can tell you is such a conversation actually took place.

In the meantime, Arcelor and Nucor advised Dofasco it could chose from either the group's two previous bids -- one of which was as high as $55.

Mr. Pether telephoned Dr. Schulz to inform him of the hostile bid. Dr. Schulz said he'd call Dofasco back the next day. It's safe to assume he called Mark Trachuk of Osler Hoskin & Harcourt right after hanging up. Mr. Trachuk and Oslers had been working with Thyssen since last summer on making a potential Canadian acquisition.

Mr. Trachuk called in Lorraine Lynds among others at Oslers, while Jonathan White of Citigroup in London and Mary Amor at Citigroup in New York were mobilized to provide financial advice.

The next day, Nov. 17, Dr. Schulz advised Mr. Pether that ThyssenKrupp was interested in making a proposal, and a management team would fly to Toronto for a meeting with Dofasco and its advisers the following day.

Dofasco's special committee informed the full board of ThyssenKrupp's interest, and advised the board that based on the advice of their financial advisers, they were rejecting the revised Arcelor bid.

Dr. Schulz and his team arrived as promised Nov. 18. There were meetings. They went well. Dofasco and Thyssen signed a confidentiality and standstill agreement and Thyssen was given access to non-public financial information.

The board told Arcelor that its bid had been rejected. Later that day, DS advised the board on what it felt would be an appropriate price. Someone, somewhere, among the advisers was also providing advice on what would be an appropriate menu.

The two management teams had a clandestine dinner in one of Oslers' board rooms. No lawyers, no bankers -- and no restaurant. "It had to remain secret," says someone who knows. "They really hit it off. The social dynamics are important in these types of things."

Nov. 21, Dr. Schulz wrote Mr. Pether formally indicating Thyssen was prepared to outbid Arcelor, with a deal that included a $200-million break-fee. Dofasco looked at the offer and told Thyssen it wasn't high enough. At that point, Arcelor was still at the table offering to bid more. The next day, it did.

Nov. 22 Arcelor and Nucor submitted what they said was their "final offer," a complex cash and share deal. What they didn't know is Dofasco already had a higher bid.

ThyssenKrupp, meanwhile, upped its price. Dofasco's board met, reviewed the bids, and decided Thyssen's was clearly better although it felt the break-fee was too high and the price was still too low.

In the wee hours of Nov. 23, we're talking 1 a.m., Arcelor issued a press release going public with an all-cash bid of $56, which was higher than previously indicated. Later that morning, Dofasco got a letter from ThyssenKrupp topping its previous offer, and Arcelor's publicized offer as well.

Dofasco again sent it back, saying it was still too low. Dofasco's board met later that morning and decided the Thyssen offer was approaching the magic number, but directors were concerned the break-fee was too high. The board held a discussion on the risks and benefits of conducting a full auction.

We imagine Dofasco's advisers would have told them that with the company in play, they would be smart to contact other strategic buyers to make sure there were no other interested parties.

The board meeting adjourned. Phone calls were made. The responses were lukewarm at best. When the board met again that afternoon, it was told that Dofasco management and its financial advisers had contacted a number of steel companies and none indicated an immediate or strong desire to enter into significant discussions to buy the company.

Later that day, Thyssen came back at $61.50 plus a lowered $100-million break-fee. The deal looked pretty attractive. Dofasco's board decided to give Thyssen an exclusivity agreement good until Dec. 5 to do due diligence.

Thyssen went in, had a look, and informed Dofasco on Saturday, Nov. 26 that it didn't need until Dec. 5. The company asked Dofasco if it would be ready to sign and announce on the morning of Monday, Nov. 28.

Everyone, of course, had coteries of tax lawyers, competition-law lawyers, and Investment Canada types involved. But the bottom line is the $5-billion deal was drafted, documented and negotiated in five days. And some people wonder why some people have God complexes. . . .

Latest on Stelco

09 December 2005

Vincor - All Hope is Not Lost

Vincor, which has brands such as Inniskillin and Jackson-Triggs, has said a bid between C$39.33 and C$76.14 a share was adequate to gain access to its confidential data.

So, $40 might be a reasonable comeback bid from Constellation in the new year...as I said before, see how the next quarterly results pan out for Vincor.

Current News on Stelco Plan

Stelco offering voters new deal

Steve Arnold

The Hamilton Spectator9 December 2005

The Hamilton Spectator Final

A01Copyright (c) 2005 The Hamilton Spectator.

Intense negotiations have produced a new restructuring plan for Stelco. The latest proposal, the fourth plan this month aimed at ending nearly two years of bankruptcy protection, was approved yesterday by the board of directors. It goes to a vote of creditors today.

Previous plans had tried to satisfy two very different demands from bondholders. First, they wanted cash in addition to new debentures. Then, when a German steelmaker offered $4.8 billion for Dofasco, they demanded new shares that they could sell to any buyer in the market for Stelco.

This plan tries to satisfy both. Under it, Stelco creditors will get a pro-rated share of $275 million in new notes, more than $106 million in cash, 1.1million common shares and the right to draw from a pool of more than 5.6 million new shares which can either be held or sold to equity investors for $5.50 each.

In an interview, Stelco president Courtney Pratt said he's hopeful this version will be the one that finally ends the company's long nightmare by letting creditors choose how they will be paid.

"The changes are very specifically responding to bondholder concerns and give them the opportunity to take shares rather than cash," he said. "They have the option with this plan."

While Stelco's bondholders helped negotiate the newest plan, Pratt said none had committed to supporting it. "Right now, I don't know what the vote will be, but I am hopeful that we'll get a yes vote because we've listened and we've restructured the plan," he said. "I hope these changes will be what's required to get us a yes vote but it's still possible that this plan could be further amended before we take the vote."

Under Stelco's bankruptcy protection, creditors holding two-thirds of its $640-million debt must vote in favour of a restructuring plan which will then be taken to Superior Court Justice James Farley for final approval. Failure to get creditor support could result in a court-ordered sale of the company or a push into receivership by operating creditors if the protection order is not extended at the company's next court appearance on Monday.

Court documents for the sale have been prepared by the United Steel Workers and the motion for a receiver has been filed by Stelco's operating lenders, owed about $217 million.

The pool of new shares to be offered creditors was created by Tricap Management Limited and two investment partners agreeing to give up some of the stake in Stelco they were to get in exchange for lending the company $375 million. Those investors have agreed to buy almost 19.4 million new Stelco shares for more than $106.5 million to prime the pool from which creditors will draw. Any shares left in the pool by creditors will then be purchased by the investors, potentially topping the fund up to $137.5 million.

Elements unchanged from previous plans include paying $400 million toward Stelco's $1.3-billion pension deficit and providing money for new equipment the company says is vital to reducing its production costs. Much of the pension downpayment will come as a forgivable loan of $150 million from the provincial government. Ottawa is also kicking in $30 million for energy projects.

The balance of the pension shortfall will be settled over 10 years with annual payments of $65 million for five years and $70 million for five years starting in the second half of 2006.

Existing shareholders get nothing. Voting on the new plan will be conducted at the International Centre in Mississauga, starting at 10 a.m. In a letter to employees yesterday, Pratt said failure to reach a deal doesn't mean plant gates will be locked immediately and "your wages, benefits and other terms of employment will continue in their current form.

Stelco's directors Wednesday rejected a plan put forward by bondholders. That would have seen Tricap allowed to buy 10 million new shares for $5.50 each. That money would go to creditors along with 15 million shares which senior debenture holders could then buy for $5.50 each. Creditors would also share in $275 million of secured notes and an additional 1.1 million common shares.

If Tricap dropped out of Stelco's refinancing, the bondholders offered to arrange their own package. In another development yesterday, Stelwire workers in Hamilton voted 95 per cent in favour of a deal with the plant's new owner. Stelwire, with plants in Hamilton and Burlington, is one of the subsidiaries being sold by Stelco.

The pact will see the company's Burlington operation close and work consolidated in Hamilton. It includes an early retirement incentive that will allow workers age 55 with 15 years service to leave with a full pension.

"People are happy with this because we're going to restructure and put the business back on its feet," said union president Scott Duvall. "We're sad to be leaving the Stelco chain after 50 years, but we know we have to move on. Settling this will be a real burden off people's minds."

06 December 2005

Vincor - Holding Out

Nortel - Let's Move Up!

05 December 2005

Personal Thoughts - US Steel

Personal Thoughts - Tim Horton's IPO

28 November 2005

Dofasco and Vincor

Vincor is holding fast, expecting the shareholders to reject Constellation's current offer of $35. I still think they will come back in the new year. I will follow the run until Q4 2005 reports, and see if it will be a possible buy at $40 for Constellation.

27 November 2005

Thoughts and Comments for the end of November

* Stelco vote tomorrow on the restructuring plan. Look for the stakeholders to accept it as is, and wipe out the common shares. More on when they come out of restructuring in January, as to whether they will be a good buy.

* Sony is having its problems. I still maintain that in Q1 2006, it will be depressed, and with news that Microsoft is selling Xboxs at a loss (software is the money maker), Sony should bounce back on the announcement of PS3 coming out. I heard that the PS3 can play any game on disk...if thats true, there may be more people lining up to buy those than the Xbox, due to older game inventories on the homefront.

* A while back, I mentioned that Walmart would be a big winner this season. Numbers out so far show that they did well this weekend, and will gain momentum over the holidays. I still think they will beat expectations next report. Overall shopping in the US was expected to be 22% better than last year.

That's all for now. Congrats to Edmonton on winning the Grey Cup!

25 November 2005

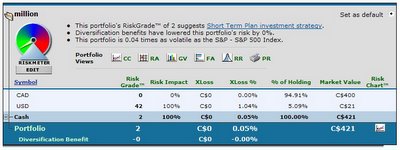

Updated Portfolio - November 2005

Still all cash, until the new year, and then I'll make the move over to an e-trade account.

Stelco Restructuring Plan

Note - the pension contribution holiday ends after 6 months after restructuring...so, look for charges of $30-$35 million against each of the Q3 & Q4 next year. We need to see the IPO of the new shares in Jan before we can crunch the numbers. Remember also, that GM just renewed the contract with Stelco, BEFORE it announced the plant closures.

Dofasco Under Attack

TORONTO (Standard & Poor's) Nov. 23, 2005--Standard & Poor's Ratings Services today said it placed its 'A-' long-term corporate credit and senior unsecured debt rating on Dofasco Inc. on CreditWatch with negative implications after Luxembourg-based Arcelor S.A. (BBB/Stable/A-2) announced a C$4.3 billion unsolicited cash offer for the company's shares. The CreditWatch stems from the likelihood that the ratings on Dofasco would be lowered two notches to be equalized with those on Arcelor if the transaction is completed.

My guess is that there will be someone else that comes into the picture and makes a grab for Dofasco. If I had to guess, Gerdau SA (or TK) might come in as white knights and compete. I think that it will be sold at $64, with QCM included.

22 November 2005

Vincor - Can a Friendly Deal Be Done?

Stelco is still without a plan, with a current vote expected tomorrow. The only thing that will get everyone on-board will be another $100 million from the government...will they cave and give in? Maybe there is a creative way the government can come to the table, given the incentives coming down for the Big 3 auto.

RIM, closing down to $78.88, I still support the $62 target...

Disney is another up and comer to watch...stay tuned to see what happens with Pixar, and the lineup for the movies for 2006. They are off to a good start...look for earnings to beat the street.

19 November 2005

Update - Miscellaneous

* GM has sunk to a new low this week, which is making it attractive, if they can turn things around. Having a smaller market cap makes it an ideal takeover target, except for the $77 billion liabilities. Kerkorian might have some ideas in the weeks and months ahead.

* Stelco problems are continuing, with no vote yet. Monday (21 Nov) is the new date, and if the bondholders don't get on board, look for the provincial government to step in and increase their contribution.

* Here is my current "watch list" of stocks;

Be sure to check back on a regular basis, as I keep tabs on what's happening in the markets.

15 November 2005

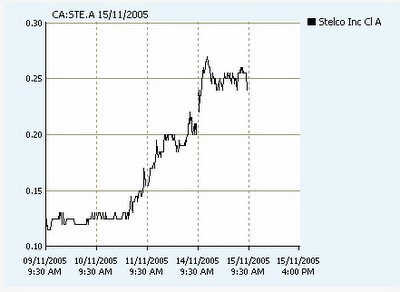

Stelco D-Day

Since the end of last week, Stelco has garnered almost 100% in value, of course, on the premise that the current restructuring plan will be voted down by bondholders. Stay tuned, lets see if we can get the 6 cents we were looking for a few weeks ago.

13 November 2005

Updated portfolio

As we had discussed before, current holdings are cash, until there is enough (min. $500 to open an e-trade account)...looks like the target date for opening the account will be Jan 2006...stay tuned.

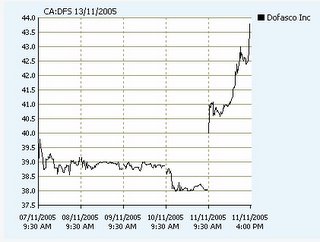

In other news, Dofasco climbed 13% on the day, on news of creation of an income trust for its QCM holdings.

Look for better gains towards the end of the year, and reporting of Q4 results in Jan 2006, with DFS and the QCM units.

11 November 2005

Explanation of Income Trusts

Vincor Being Stalked

10 November 2005

Odds and Ends

Nortel is down a bit...it will bounce back...

09 November 2005

Nortel Status

The Next Big Techs?

I like the idea of a gaming card that compensates for lag. This would be a cheaper alternative to people out there with older PCs that don't want to spend the money on a faster computer...just a thought...

On the Stelco front, bondholders are holding their ground about vetoing the restructuring plan, and the shares moved up 13% today (11 cents to 13 cents on the TSX), with debentures dropping down 6%...CEO Pratt will have to work wonders to get everyone on board. Big vote is scheduled for 15 Nov....stay tuned.

05 November 2005

The Next Tidal Wave in Advances

Today, the signs around us are just as difficult to read, but, as Yogi Berra once remarked, "You can see a lot just by looking." What will be the next half-century's all-transforming technology? And who will reap the riches to become the next Bill Gates?

SIGNS OF CHANGE. I believe the answer lays in the confluence of three heretofore largely separate trends:

• The evolution of semiconductor-manufacturing capabilities and products into nanoscale dimensions.

• The increasing ability of biochemists to engineer genetic material at the molecular (nano) level.

• The exponential growth of computer simulations permitting the design of clusters of atoms at the nano dimension.

For decades, each trend evolved separately. But today, these trends have come together, amplifying each other's capabilities and forming the nucleus of what I call the 3N revolution.

SIZZLING SYNERGIES. Why these three trends?

First, they are each attracting huge numbers of very smart scientists and engineers from around the world -- and one should never underestimate the potential of combined intellectual horsepower.

Second, all three trends are already beginning to overlap in highly productive ways. The gene chips from a company like Affymetrix rely on semiconductor processing in their manufacture, new materials are now made directly in the computer rather than empirically on the lab bench, and the Human Genome Project depended as much on high-speed numerical analysis as on wet chemistry.

03 November 2005

More on Stelco's Situation

Court deliberates over Stelco

by Laura King in Toronto3 November 2005

TheDeal.com Copyright 2005, The Deal, LLC. All Rights Reserved

The Ontario Court of Appeal has reserved its decision on whether to throw out two financing deals that form the crux of the restructuring plan for insolvent steelmaker Stelco Inc.

The three-judge panel said Wednesday, Nov. 2, it will rule promptly, but Stelco CEO Courtney Pratt said the company must make changes to the restructuring plan to satisfy the bondholders who oppose the deal.

Meanwhile, Stelco announced that it is selling three of its units to Mittal Steel Co. NV. Stelco creditors are to vote on the its restructuring plan on Nov. 15 but a group of bondholders, including some U.S. hedge funds, say they'll veto it.

The group opposes two deals included in the plan. The restructuring plan requires approval by creditors holding at least two-thirds of the money owed, or about C$640 million ($545 million).

"We shouldn't kid ourselves,'' Pratt said outside court. "This plan is not going to get accepted.'' Stelco has been under creditor protection since January 2004. Justice James Farley of the Ontario Superior Court approved its restructuring plan on Oct. 4. It includes a deal with the Ontario government for a C$100 million loan that is contingent on Stelco making a C$400 million down payment on its C$1.3 billion pension solvency deficit, which the bondholders say is excessive. Under that deal, $75 million of the C$100 million loan can be forgiven and the province could end up owning 8% of the Stelco.

A second deal calls for Brascan Corp.'s Tricap Management Fund to provide C$450 million in financing but the bondholders say fees associated with the deal are too high. The bondholders say Stelco didn't actively seek competing proposals.

Tricap could end up with a multimillion dollar breakup fee if the deal collapses. Lawyers for bondholders argued Wednesday that Farley shouldn't have approved the restructuring plan knowing that the bondholders intend to vote against it.

Bondholders would be paid about 66 cents on the dollar under Stelco's restructuring plan, which would be more than creditors of Bethlehem Steel Corp. and other U.S. steelmakers received after restructuring. Stelco shareholders would end up with nothing.

Stelco is aiming to exit creditor protection by Dec. 31. Stelco said it has signed a letter of intent with Mittal and that the sale hinges on the negotiation of a definitive agreement. It didn't disclose a price for the sale of Norambar Inc. in Contrecoeur, Quebec, Stelfil Ltée. in Lachine, Quebec, and Stelwire Ltd. in Ontario.

Stelco announced early in its restructuring process that it would sell the divisions, which it considers noncore, in order to focus on its integrated steel business.

01 November 2005

Top Stocks to Watch - CNN Money's Sivy's 70

Nortel clears last hurdle, we hope

27 October 2005

Research in Motion - Legal Problems

On an interesting note, there were terms of an agreement that was drafted earlier this year, but lacked a meeting of the minds to seal the deal, which includes for licensing arrangements.

So, whats the future hold in store?

I think RIM will bounce back relatively quickly, although not to the same high levels as before. Some analysts are picking target prices of around $62...it will just be a matter of how much NTP will agree to settle for. My guess is a modest premium above the last one, with RIM taking the hit in Q1 2006, so look for improvements after that. RIM will sign quickly, as the technology is partnered with others.

26 October 2005

I'm Back...

Anyways, since the last entry, it has been time to deposit to the cash account, to build up enough for opening an e-trade account. Balance stands at $321, which includes a deposit of $100 CAD, and I found some USD laying around, and added that to it...hence the $321. Every dollar helps!

In other news, Nortel is being played by the profit takers, so it has been up and down around $4 for the past 2 weeks.

I had suggested Stelco, to see if we could get in and speculate the loss of votes for the restructuring plan currently on the table...it hasn't panned out that way yet, and rumour has it that the current plan will yield 66% to creditors (through equity and shares), versus 17-33% if the plan is voted down, and the company left to sell off assets. It is currently at 15 cents. In related news, Mittal paid a premium for the Ukraine state-owned mill, of $4.8 billion, expecting the steel market to rebound from where it is now...as a result, look for low P/E steel stocks to make some ground in Q1 2006. Algoma is holding on to a lot of cash, but hasn't decided what to do with it. Paulson, whose company holds 19%, is asking for a cash dividend, putting pressure on the board to do that. With a low P/E, prices going up in Q1 2006, look for a substantial return on Algoma in the next 6-9 months.

17 October 2005

Nortel is even a better pick now...

Nortel is making some changes at the top...see the article here.

As a result, Nortel closed at 4.10 today...look for big things to happen in the next few quarters.

11 October 2005

Spam Stock Tips....Are They Worth It?

http://www.spamstocktracker.com/

Don't ever think you have missed out on a good trade when you read these emails!

Finding Value in Markets...

Keep in mind, you still need to look at the company in more detail, but the above should weed out a few stocks you may be interested in.

I am looking at a few stocks now, and will blog about them later in the week when I do a little more digging.

10 October 2005

Bankruptcy Details on Stelco...Questions Answered

The great Stelco guessing game

How did we get here? What's at stake? What happens next?

8 October 2005 Copyright (c) 2005 The Hamilton Spectator.

Stelco has teetered on the brink of collapse so many times in the last 20 months, it's almost become routine. In less than two years since the steelmaker sought bankruptcy protection, there have been marathon negotiations, countless court dates, bankruptcy protection extensions and enough lawyers to populate a small country.

Add to that a scant bankruptcy act that leaves those lawyers lots of wiggle room and you have a situation that would confuse even the most brilliant legal or economic mind.

So what's the situation all about and what does it mean? Here's a look at the essential elements of the latest in the steelmaker's fight to get out of bankruptcy.

What is the Companies' Creditors Arrangement Act?

The CCAA is the bankruptcy protection legislation which allows Stelco to put off paying its creditors until it has reorganized.

Unlike its predecessor -- the Bankruptcy and Insolvency Act -- this depression-era legislation is short on strict deadlines and structure.

Why did Stelco seek that protection in the first place?

Stelco CEO Courtney Pratt said the company had no choice. The board of directors said the steelmaker was poised to run out of cash within months. It had lost $168 million in the first nine months of 2003, had a $545-million, long-term debt and was $1.3 billion short of what it needed to cover pension obligations.

Since then, booming steel prices have made unprecedented profits, prompting unions to argue the company wasn't really insolvent in the first place.

Why has the company needed so many bankruptcy protection extensions?

It's not uncommon for companies to get bankruptcy protection extensions but Stelco's 11 extensions have set something of a record.

Steel expert Peter Warrian said this restructuring has been painfully drawn out because of the large number of stakeholders who need to agree. Plus, the University of Toronto professor said, rising steel prices and soaring profits made the situation seem much less dire, sapping any willingness to compromise.

Stelco is poised to request its 12th and, hopefully last, extension Dec. 2. What has the company been doing these last 20 months? Besides requesting bankruptcy protection extensions, the company and its unions have been hard at work -- taking turns bickering, negotiating and shopping around for the best financing deal.

The steelmaker's unions spent the first few months of bankruptcy protection fighting Stelco's insolvency claim in court. When that was rejected, they started negotiating a new collective agreement for Lake Erie workers.

At the same time, both sides searched for a financing deal. After a number of bids, Stelco and its unions settled on the Tricap deal.

What is the Tricap deal?

Under the deal, the province chips in $100 million towards the pension shortfall while Tricap gives Stelco a $350-million renewable loan secured to the steelmaker's assets. Tricap also insures Stelco's attempt to get another $75 million through the sale of secured notes -- IOUs which can be converted into stock.

The deal gives unsecured creditors $225 million in secured notes and $300 million in the form of unsecured notes which can be converted into shares.

In return, Stelco will give Tricap $1.6 million for expenses and pay a $10.75 million "commitment fee" which Tricap keeps if the deal falls through.

Who supports the deal?

Stelco is on board, as are the company's salaried retirees and the unions representing AltaSteel and Lake Erie workers.

Who wants to see the deal killed?

Stelco's largest union, Local 1005 which has boycotted the restructuring negotiations, says the deal poses "enormous risks" and doesn't address the core problems facing the company.

But the bondholders are the deal's most powerful opponents. Bondholders, the steelmaker's largest group of unsecured creditors, are hoping to get a better deal which pays them in hard cash rather than in Stelco stocks.

Who are the bondholders and why do they have so much power?

Bondholders are a mysterious and anonymous group of investors. Sometimes called "vulture capitalists," they often buy up cheap bonds from nervous investors when a company is in trouble.

They then use their influence during the restructuring process to increase the value of their bonds and make a profit. Their influence, in this case, is considerable. Because they make up the majority of the steelmaker's unsecured creditors, they have a deciding vote on any financing deal and could effectively kill it.

The unsecured creditors are scheduled to vote on the Tricap deal Nov. 15.

How does their vote Nov. 15 work?

Every dollar owed equals one vote on Nov. 15. Since $660 million is owed, there will be 660 million votes cast. The bondholders -- with the most money invested in Stelco -- will cast the majority of those votes.

Each of the five companies under the Stelco umbrella will be voted on separately. The votes will be counted by the end of the day. A location for the vote has yet to be determined.

What happens if they vote it down?

It won't be the first time. Bondholders voted down an endorsed deal in the restructuring of Algoma Steel. They were ordered into a hotel with the company, not to emerge until they had a deal. Several days later, they had one.

But if the bondholders vote down the Tricap deal, it will die. Pratt said it would then be up to Farley whether to liquidate the company or have it emerge from bankruptcy without a plan -- neither of which, he said, are good for the company.

What happens if they vote in favour?

Even then, Stelco wouldn't be out of the woods. The deal then goes back to Farley's courtroom. That's when Farley will hear objections to the deal, possibly from shareholders, and decide whether to approve it or not.

In the end, whether Stelco emerges intact or is liquidated rests in his hands.

Could bondholders kill the deal before November?

They are doing their utmost to do exactly that. Bondholders launched a court appeal Thursday, objecting to Farley's tentative approval of the Tricap deal. If the appeal is successful, it will essentially kill the Tricap deal.

What happens to shares and shareholders under this deal?

Stelco shares won't be worth the paper they're written on if this deal is done. Since they are at the bottom of the bankruptcy food chain, they are going to be left with nothing to show for their investment. They could launch a long and expensive lawsuit to recover some of their money but experts say it's a fight they will likely lose.

What role do the unions play?

Unions have a lot of leverage in this restructuring. That's because workers at Lake Erie and AltaSteel both had strike mandates and the renegotiation of their collective agreements became tied to the restructuring process.

Local 1005 is not in the same boat -- because they have a valid collective agreement, they are not in a legal strike position.

While the Lake Erie and AltaSteel locals have a new collective agreement, their members won't vote on their new collective agreement until after bondholders have voted on the Tricap deal.

That essentially gives union members a final say on the restructuring plan, so Stelco will have to keep their interests in mind as it negotiates with the bondholders.

What happens the day after Stelco emerges from bankruptcy?

If all goes well, come Jan. 1 it will be business as usual at the steel mills. But Pratt said Stelco will emerge from bankruptcy a completely different company, free from creditors since it will have paid them all off by the time the bankruptcy protection is lifted. It will have a new board of directors and a new financial plan while its management will remain intact.

How long does it take for a company to get back on its feet?

There can be profit after bankruptcy. Algoma Steel just had its most profitable year in more than a century in business. But it had to go through two major restructurings -- one in 1991 and another in 2001 -- and lay off 600 workers before it hit its stride this year.

It's anyone's guess how long it will take for Stelco to post a profit once it emerges from bankruptcy, but the steelmaker has been making fistfuls of money throughout its bankruptcy protection thanks to a spike in steel prices.

What happens to Hamilton if Stelco doesn't survive?

Hamilton doesn't have its reputation as Steeltown riding just on the survival of Stelco. There are at least 16,000 jobs in Hamilton related to the steelmaking and processing industry. Then there are at least 500 Hamilton companies who deal with the steel industry.

City hall is equally concerned about Stelco's fate. The city's coffers get $10.5 million in taxes from the steelmaker, plus $4.5 million toward education.

08 October 2005

Quick note on Energy stock prices

- energy stock stabilization Friday is going to give a false sense of security of the next little while

And enjoy the Canadian Thanksgiving weekend...:)

06 October 2005

Today's Surprises...

Items of note:

1) HD-DVD and Blu-Ray format wars heating up...both expecting something out in early 2006. Unless Sony can do something with their biz plan, electronics are not attractive right now.

2) Costco and WalMart both looking at higher revenues going into the holiday season

3) Stelco still uncertain, but might be able to scavenge a few dollars if you want to take a chance that the current restructuring plan on the table gets voted down...I predict at least a 20% in value change up, before 15 Nov plan vote (current price $0.26 - look to sell when it hits $0.32)

Market Performance...

05 October 2005

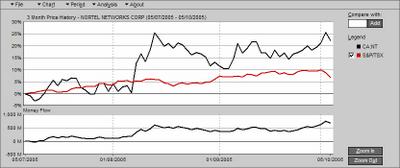

3 Months of Nortel Networks...

This shows a return on investment of 20% in the last 3 months...

This shows a return on investment of 20% in the last 3 months...Just goes to show, that there is money to be made out there...

Pricing Power...

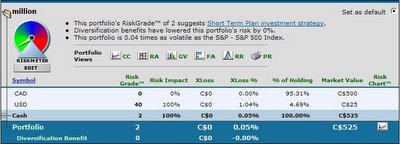

More on riskgrades.com Part 2

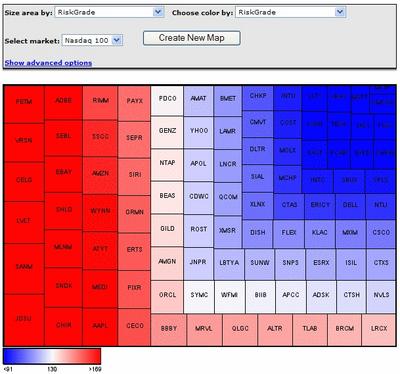

The map above shows the Nasdaq 100 last week. You can get a current snapshot by going to the riskgrades.com site.

More on riskgrades.com...

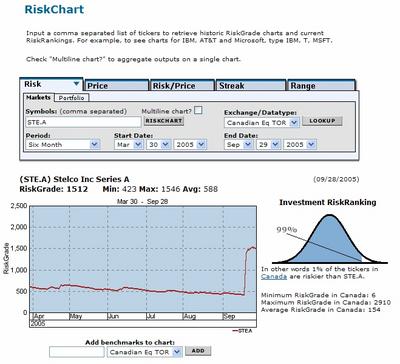

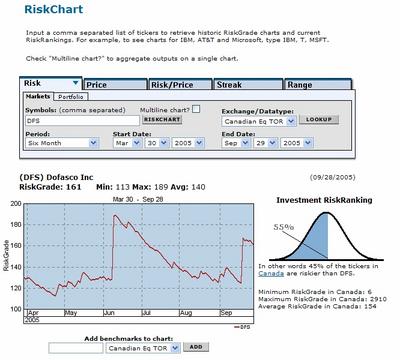

I have looked at a couple of stocks to see how it works. The example below, shows Stelco…

I have looked at a couple of stocks to see how it works. The example below, shows Stelco…

As seen in the chart, Stelco was, and still is, a high risk, due to CCRA proceedings, and the sudden increase in RiskGrade, is when the restructuring plan was presented to the court, which gives existing shareholders nothing in the new company.

As seen in the chart, Stelco was, and still is, a high risk, due to CCRA proceedings, and the sudden increase in RiskGrade, is when the restructuring plan was presented to the court, which gives existing shareholders nothing in the new company.Another stock I checked, Dofasco, shows how it is less risk, and the change in risk, as advisories and earnings reports are issued.

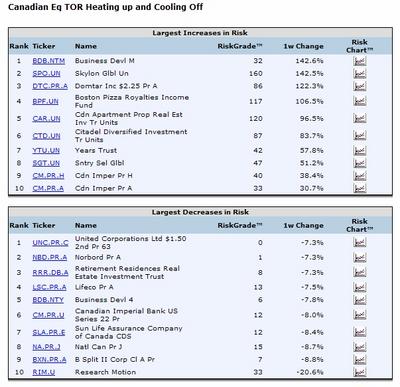

I was also able to pull a clipping off their site, that shows the movers and shakers with respect to risk…the table below shows the biggest weekly changes in risk for Canadian Equities TOR;

I was also able to pull a clipping off their site, that shows the movers and shakers with respect to risk…the table below shows the biggest weekly changes in risk for Canadian Equities TOR;

This kind of information will be key to our success. Feel free to go to the site, and play around with the tools, and get familiar with what's available.

Additional Links...

Usually, when a credit agency downgrades a company’s debt or bonds, this results in a drop in share price, and when looking at the company’s balance sheet and P/E ratio, we can look at the potential return on share value, based on this information.

Some other interesting reading for today:

http://finance.sympatico.msn.ca/investor/investmentbasics/section1/sec1article1.asp

Please note, that I have added a PayPal donation button, to offset the costs associated with developing this site, and research costs.

I will be posting a few blogs today, related to more background information, along with additional links I find relevant.

03 October 2005

The First Step...

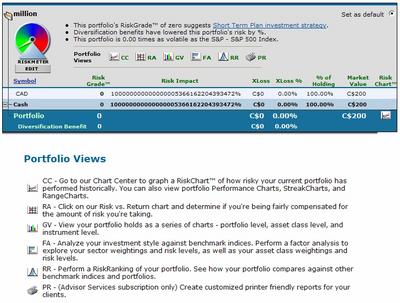

1) I had mentioned that 1 Oct 05 was the start date for establishing the savings account for our contributions. I also mentioned that ING Direct has a no-fee investment savings account. At this time, I have established regular biweekly payments into a credit union account for now, starting with the first $200 deposit 30 Sept 05. I will be transferring it to ING Direct, once I set up the deposits to go to ING automatically from my credit union account. The journey has started!

2) I wanted to give more information on the basics of investment strategy, but I have been researching the riskgrades.com site, and find it intriguing. I have set up the portfolio above, and in the next blog, I will give details on how it works, and how it can be a useful tool for capturing risk, and additional information for making our decisions on investing.

** keep in mind, that the tools used above, are only tools. You may wish to use another method of tracking for your investments **

Good luck with your investments!

28 September 2005

Investing Knowledge Lesson #1

Keep in mind, that we are looking at gaining as much knowledge on how the market works, what to look for, and how to read the information, in preparation for moving into the world of e-trading going into 2006. When we are looking at potential stock buys, there are 6 major considerations in picking a stock;

1. KNOW THE COMPANIES

Every fund manager agrees that knowing the companies as thoroughly as possible -- a strong grasp of their financials, their products, their suppliers, their managers, and customers -- is key to controlling risk.

2. DIVERSIFY AMONG SECTORS

Individual investors can study correlations and volatility at a free Web site, riskgrades.com (details on how the riskgrades.com site works, and what to look for, will be covered in a future entry). The site assigns each stock a "risk grade" and then one for your portfolio. Ideally, the risk grade of the whole should be less than the average of the parts. One caveat: Risk is always changing, so you need to monitor it. We will be considering a variety of stock holdings in the future, in order to minimize our risk.

3. MARGIN OF SAFETY Value managers have their own form of risk control called the "margin of safety" that's straight out of financial textbooks. They'll buy a stock only at a deep discount to what they perceive is its "intrinsic value," or the price it would fetch in a private acquisition. The idea is to buy at prices so low they have little room to fall.

4. DIVIDENDS Stocks that pay dividends are generally less volatile than ones that don't. For one thing, the cash flow from the dividend cushions the portfolio in bear markets. In addition, many investors who own these stocks hold them for the long term so they can collect their payouts, thus reducing the daily volatility caused by active traders.

5. "ECONOMIC MOATS"

These companies often succeed because they have competitive advantages or "economic moats" that protect their businesses. Stryker, the dominant player in the orthopedic implant industry, is one such “moat”. True, it has patents protecting many of its products from competitors, and patents eventually expire. But what won't change, is the growing ranks of seniors, who are the main customers for Stryker's products.

6. DEFENSIVE TRADING

Many investors would not associate frequent trading with low-risk portfolios. Risk can be kept in check with lots of buying and selling. The idea is to weed out stocks that have hit price targets or have fallen.Here's how the defensive trading works. Nextel was at 15 a share in June, 2003, then hit 26 in December of that year. In June, 2004, the stock dropped 20% on worries about a competing technology. If you decided that the concerns were insignificant, you purchased the stock again at around 21. You could have sold it once more late last year for a 17% gain when news broke that Sprint would be acquiring Nextel.If a company has an ugly earnings report that is not the result of a one-time event, then it’s probably a good idea not to hold onto that stock for above average returns.

These points are critical for future analysis that we will be doing. Happy reading, and as always, feedback is welcome, and if you have a question, feel free to leave a comment.

Up Next Blog – Investing Knowledge Lesson #2

23 September 2005

Previous Research - Great Returns!

In this blog entry, I will outline a few examples which I had been following on paper, to see what could be done…the information will surprise you!

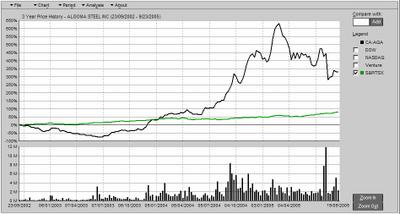

Algoma

Granted, looking back at what happened with Algoma’s stock, it may seem that its easy to look back and play the “should have” game – that is, look at what the investment could have done, if, if, if….

Algoma had gone through some tough times a few years back. They restructured, and came out of bankruptcy, and if you consider the cash flow intensity of the steel business, you can see that any nominal gains in the price of steel, is going to create more of a cash flow to the business. The chart above shows that after they had restructured, the increase in the share value steadily followed the price of steel on the market. This was primarily due to supply and demand, with the biggest effect on the market being the voracious appetite of China to buy up as much steel as possible, to build their infrastructure. What has helped with the demand for steel, was the fact that China secured the Olympics in 2008, and in addition, China is improving its presence on the world stage with respect to economic development. Granted, Algoma is only a small supplier in the world market, but when the global demands for steel are in the order of millions of tons, all steel companies are affected, with the price of steel soaring to record highs. This market condition has resulted in a few good stock picks in recent years, with Algoma surging ahead to return 600% on stock value in about 1 year. The key connection that had to be made to pick this stock as a winner, was to realize that when the Olympics were awarded to China, eventually their infrastructure had to improve, and you had to look for value in the steel stocks as they came up. In the future, look for India to follow in China’s footsteps, and improving their infrastructure.

Stelco

Some people may disagree with the choice of picking Stelco as a stock with a great return potential. However, given the conditions of the market, and the capability of Stelco to produce steel and make money during the soaring steel prices, while under bankruptcy protection, choosing Stelco under the circumstances would have been a wise choice…

When Stelco entered bankruptcy in January 2004, the conditions under which it filed, was that its pension obligations couldn’t be met if it had to wind up its business. This decision, although at the time was a prudent move on behalf of their management, resulted in the price of Stelco stock to drop. What had helped its return to profitability, was the price of steel on the open market hitting above $700 US a ton (see explanation above under ‘Algoma’) in Q3 2004. As a result, price/earnings ratio for Stelco was extremely low, resulting in a huge value for investors. What gave the investor an opportunity to make money, was the fact that there was belief in the market that Stelco had some value with the profits coming in. This raised the stock price 250% in a short time (approximately 10 months). Granted, it was a gamble that the stock would have had any value after restructuring, but with the in-fighting between creditors, management, and the union, this gave the investor time to make gains in the stock value, before it has hit rock bottom recently, on news that the current restructuring plan before the courts, will wipe out current shareholder value. If you timed it right, you could have made a very good return in 2004-2005 on Stelco stock.

Nortel

Nortel has had its problems in recent years, from being the “darling” of tech stocks, to being plagued with accounting scandals.

Given the fact that its stock value has been beaten to death by accounting errors and restating, Nortel still does a brisk business with over $9 billion in revenue for 2004. In recent years, Nortel has been trimming its work force, and still maintaining a decent revenue, although there have been slight losses in recent years. The above link, gives a profile and analysts’ reviews of Nortel. Recently, they have secured a few contracts to provide their systems for telecommunications in Asia, and given the fact that all the accounting has been fixed up, look for steady increases in shareholder value this year. Q2 2005 reporting, seems to have leveled out the financial problems of Nortel, and looks like it is set to give big returns on value for the next year.

I realize that it is nice to look at the stocks after-the-fact, but the information is out there to realize good gains in stock value. This blog will outline information to make some aggressive picks for our portfolio in the months ahead. As I mentioned before, once we have enough in our savings account, we will open an e-trade stock account, and start to apply our research, and reporting the gains on a regular basis.

Up Next Blog – Some Interesting Background Information

11 September 2005

Starting Off...The Beginning...

One of the things that caught my eye in the news, and particularily the stock market was the review of the top stocks in the country, for annual returns. Every year, there are a handful of stocks that return in excess of 100% in one year. The trick, of course, is to find them! What really got me, was the fact that some stocks, even in the waning industries, like steel, were even returning 600% over a year (Algoma) for 2003-2004. There is no reason that common sense can’t dictate a conservative return of at least 100% over a year, given market performance in some sectors over the past few years.

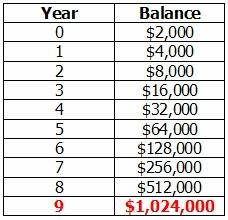

One of the things that caught my eye in the news, and particularily the stock market was the review of the top stocks in the country, for annual returns. Every year, there are a handful of stocks that return in excess of 100% in one year. The trick, of course, is to find them! What really got me, was the fact that some stocks, even in the waning industries, like steel, were even returning 600% over a year (Algoma) for 2003-2004. There is no reason that common sense can’t dictate a conservative return of at least 100% over a year, given market performance in some sectors over the past few years.Granted, there are risks…but the idea is that the money that we save, we know we want to be aggressive with it, and make the most we can for it. For a mere $200 every 2 weeks, there is a cushion in our principal investment, from the table above. If we were to take the total time frame above, and figure what our principal would be over this time, the total is 26 deposits x $200 x 9 years = $46,800. Keep in mind that I will be using my $200 contributions in this blog. Feel free to reduce or increase your contributions accordingly.

Back to my situation. I am a separated male, 42 years old, and my background is in engineering, not finance. I pay child support, I don’t work paid overtime, and the contribution I will be making is about 15-20% of my take home pay.

This is an aggressive amount, but I am hoping that once the account starts to grow, I can reduce my contributions, or adjust my returns, based on other factors, as they come up. For now, I had mentioned that the D-Day for the start of account on Oct 1. I have done some research, and found that ING Direct offers a “no fee” savings account, that will allow us to access our money on a regular basis.

This is an aggressive amount, but I am hoping that once the account starts to grow, I can reduce my contributions, or adjust my returns, based on other factors, as they come up. For now, I had mentioned that the D-Day for the start of account on Oct 1. I have done some research, and found that ING Direct offers a “no fee” savings account, that will allow us to access our money on a regular basis. Posted rates are shown to be 2.40%, and with the amount that we are starting off with, its not enough to open an e-trade account at this time. I’ll give a review on ease of setup of the ING account, closer to the end of the month, when I make the first deposit. We will be looking at opening an e-trade account towards the end of the year, ready to trade in the beginning of 2006. I will also detail the steps to set up an e-trade account, when the time comes. This is where things will get interesting. In the mean time, I will be doing more research, and posting relevant information to what I think will be happening in the markets, and the best way to make the most out of our contributions.

Thanks to all that stop and read this blog. I hope you can gain some insight from it, and even offer some information or ask questions. Feel free to click on the ad links in the sidebar too, as this is another form of revenue that I will be adding to my account. Details on how it all works, will be included in a blog later on.

Up Next Blog – Previous Research that led to Creating this Site

06 September 2005

Introduction

So what’s this about? All the information I have ever seen or come across, has always shown you how to make a million, or that a small fortune has been made, after the fact…that means, it worked for the author, but not necessarily will work for the person that buys the book! Some of the aggressive strategies suggested in these books are time-sensitive.

The basic premise of all “road to financial freedom” or “freedom 55”, is that you must pay yourself first. In order to pay yourself first, consider the account you set up as a regular bill deposit. “Pay to the Order of Me” fund. Through the life of this blog, I will be contributing $200 every 2 weeks to my “account” – this will be my working capital, and I will make various investments, high risk ventures, anything at all (legally), to increase the net worth of my account.

In addition, in order to make this work, we must be disciplined. We have to set limits around gains and losses, and have a goal in mind. It is my intention that I reach a net worth in my account, worth $1,000,000, and I plan to have this net worth before I retire, which, is in 13 years at the earliest.

The changes to the net worth in the account will be reported as total deposits (my regular contribution to the account of $200 every 2 weeks), my gains/losses for the period, and the net return excluding capital gains tax implications, but including fees, costs, etc. associated with any transactions.

So, without further ado, if you would like to watch as money grows, the first deposit will be made on October 1st! A running balance of the account will be kept in the sidebar and the date, in order to track the changes. As time progresses, I will update the blog with notes, and anything that relates to the change in net worth.

Feel free to start your own account, and use any amount you wish to start! If you follow the strategy I lay out, then you will also see the returns I will get.

I will be posting different aspects of my strategy, from what I think will do well in the short term, the long term, speculative markets, and other information that I use to make my decisions. The decisions will be posted before I make them, therefore making this blog, the pre-emptive strike to the increase in net worth!

I will be taking some time to prepare information for this blog over the next few weeks. As I prepare, I will post, and let you know what to do with it, or how it is relevant.

Up Next Blog – Details of my financial situation

Until next time, let’s make a million!

Let's Make a Million - Inaugural Post

I am hoping that all of you that are interested, will comment back on your successes, and together we can make a million!

Keep checking back, as I update this blog with more details!