23 December 2005

Personal Thoughts - Dofasco Inc.

Of course, what they both see, and probably others, is QCM in Dofasco's pocket. Given the ore reserves and production, this will more than give a solid return on their bids, with the price of ore increasing for 2006.

However, Dofasco has been generous in their compensation plan with their employees...and keep in mind, anyone that puts out $5B for an investment, strategic or not, wants a return on their investment. Will Arcelor or TK get their return on the ore assets? I think so. But, you can't help but think that after Dofasco's $150 million charge against Q1 2005 for employees' compensation (refer to 2004 annual report), that after due diligence of the books, any suitor won't come in looking to make some changes to extract value for their shareholders.

It may be a year down the road, but I expect that changes may come for any suitor to maximize the return on their investment...with pressure from boards to provide 12-15% return, somehow Dofasco Inc. has to pony up $600-$750 million in gross earnings to contribute to the suitor's bottomline.

With the gap in steel prices and commodities closing, the only place left to squeeze value is in the operating costs.

Arcelor Bids Again....$63 is the number

ARCELOR ENHANCES OFFER TO ACQUIRE DOFASCO INC.

23 December 2005 Companynews

(c) Copyright 2005 CompanynewsGroup. All rights reserved.

PRESS RELEASE Arcelor enhances offer to acquire Dofasco Inc. Luxembourg/Toronto - December 23rd, 2005 - Arcelor S.A. announces its intention to make an enhanced all cash offer to acquire all of the outstanding common shares of Canadian steelmaker Dofasco Inc. (TSX: DFS) at C$63.00 per share. Arcelor expects that the Board of Directors of Dofasco will recognize that this offer is superior to ThyssenKrupp's offer. Arcelor is open to approaches by Dofasco's Board of Directors and / or another party to finalize the acquisition at this attractive price level for the Dofasco Shareholders. Guy Dollé, Chief Executive Officer of Arcelor, reiterated that "Expansion into North America is a key strategic objective for Arcelor. We believe that Arcelor is an excellent partner for Dofasco. As a partner of the Arcelor group, Dofasco will become a stronger, more competitive steel producer on the North American steel market." Mr. Dollé also underlined that Dofasco's highly regarded corporate values with respect to its relations with employees, and its legacy of active community engagement, are principles that Arcelor shares and will continue to support. Full details of the offer will be included in the formal take-over bid and circular documents which Arcelor expects to mail to Dofasco shareholders in the coming days.

22 December 2005

2005 S&P Performance and 2006 Info

20 December 2005

Looking for a Bank Stock? Try Laurentian

19 December 2005

US Steel Value vs Dofasco

"Analysts say ThyssenKrupp's offer already is expensive, representing a 40% premium to Dofasco's share price before Arcelor launched its bid in November. In a recent report, Morgan Stanley estimated ThyssenKrupp's offer values Dofasco's steel capacity at about $1,000 a ton, while U.S. Steel Corp. trades at about $350 a ton."

As I had blogged earlier in the month, US Steel won't command the same price as Dofasco. With the difference in value, and other factors, I would like to see USX improve their results. So does Citigroup. Other agencies are soon to follow.

Comment Question - Nortel Stock or Options?

Here is a good article that gives the general concepts for others considering options trading;

http://www.investopedia.com/articles/optioninvestor/03/073003.asp

Because of the volatility with the company right now, I have no doubt that the stock price would rise over the next 6 months for a substantial gain (beats indices). However, with all the management changes going on right now with Nortel, and other factors (growth, etc.), I think that the options for Nortel are risky right now...what I think is, there are more variables affecting the volatility than what can be accurately predicted.

That being said, sure, if you had some money you wanted to risk, and after understanding all the volatility behind the premium, then yes, I would do it. The one thing that would hold me up personally right now, is that I don't have a portfolio diverse enough to take the risk. Its also hard to answer your question without understanding more of the contracts you are considering.

To put in perspective, I would option HP before Nortel, based on the what I see. With increased volatility, comes increased risk and reward.

Here is a blog I read every day, Phil's World, which gives you a good handle on what all is involved with options trading. Read about his risks and rewards.

18 December 2005

Update - Miscellaneous

- RIM is still having its legal problems. Earlier this month, I figured a target of $62 for RIM. With the courts ruling against RIM, I still maintain it will go lower ($1 billion settlement to NTP, and expensive licensing arrangement). Stay tuned.

- Stelco, well, what can be said about it. Shareholder value has been all but wiped out. With the new shares under the restructuring plan having a value of $5.50, steel prices softening in Q1, I don't expect big things from them.

- Dofasco hit the $64 mark...might be a good idea to take it now. Even though Arcelor is going to act or react sometime this year, going into the holidays and into the new year, I don't think there will be any surprises.

- Sony is still on my watch list - I can't help but think that it will be a bargain some time in the first 6 months of 2006.

- Nortel is being sluggish. No surprise there with the changes in management.

- Vincor, having defeated the Constellation takeover, still feels that Constellation's bid was oppurtunistic - I agree. Again, we'll see what happens with next quarter results.

- Laurentian Bank has been on my watch list for the last 3 months - steady gains over the last 4 weeks make it a good buy.

Personal Thoughts - GM

Seems that GM is going in spurts these last 4 quarters. My thoughts are that the new models might actually spurn some spending in the new year, within the first 6 months anyways. With Kerkorian getting his seat on the board, and a mediocre restructuring plan, I think its possible to get some value out of the stock for the next 6 months.

The big thing missing in GM's plan, is exciting models. Keep in mind GM, that stylish, affordable, reliable cars are what the public needs. GM is not in a position to challenge DCX with designs like the 300. The formula has worked well for Toyota and Honda, both which started out with the affordable/reliable route first, before they moved into styling and going after market segments.

GM, remember the KISS method - Keep it Simple, Stupid. I'll revisit GM down the road, pending developments with Delphi too.

Well-Rested and Ready to Go

Stay tuned!

11 December 2005

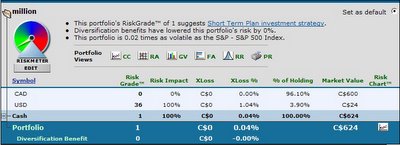

Updated Portfolio - 9 Dec 05

$624...another $999,376 to go.

$624...another $999,376 to go.

10 December 2005

Inside Scoop on What Happened with Dofasco

Dofasco board shows steel in Thyssen deal: Behind the scenes, board and advisors forced higher offer

Sandra Rubin

Financial Post 7 December 2005

National Post National FP9(c) 2005 National Post . All Rights Reserved.

We were interested to see reports last week that Dofasco CEO Don Pether took it on the chin from some hedge funds for signing a $61.50 a share friendly deal with ThyssenKrupp instead of soliciting higher bids. Mr. Pether's tongue must have been bleeding. What they didn't know, and he couldn't say, is that Dofasco's management and financial advisers had personally contacted all the usual steel industry suspects to ask them if they wanted to mount a bid -- and got Thyssen to up its own bid at least twice and cut the break fee in half before signing a deal.

The whole saga started May 27 with a $43 a share joint offer from the Luxembourg-based steelmaker Arcelor and U.S. steelmaker Nucor Corp.

People thought the sale was going to go ahead then. In fact, we hear Jon Levin, who was working with Joan Weppler, Dofasco's vice-president and general counsel, and a Fasken Martineau team that included Wally Palmer and Sean Stevens, actually cancelled his summer vacation. (For those of you who don't have your list handy, that's No. 17 on the Top 50 Ways to Make Yourself Popular at Home. It's a Category 33.6 offence, punishable by jewelry.)

When the $43 offer landed, Dofasco retained a team led by Peter Buzzi at RBC Dominion Securities to provide a fairness opinion and its view can be distilled thus: unfair. A short time later, the Arcelor group, which was being advised by a team at Ogilvy Renault headed by Marc Lacourciere and Terry Dobbin, upped its bid to $46 in cash plus a share of Quebec Cartier Mines.

Things really only heated up Nov. 10 when Arcelor and Nucor (being advised on the financial side by Jim Kofman and David Bain of UBS Securities) sent Dofasco a letter saying they were willing to pay $52 a share if the bid was hostile, and $55 for a friendly bid that allowed them to do due diligence.

Oh, and at that point Arcelor threatened to circumvent the board and go directly to shareholders. The board thought about it over the weekend and met Monday, Nov. 14 to discuss the situation. They sent the Arcelor group a return letter, saying the latest offer didn't appear to fully value the company. They suggested the group meet with Dofasco's financial advisers.

Nov. 16, Dofasco's special committee met and asked Mr. Pether to contact ThyssenKrupp to see if the German company would be interested in making an offer.

The two companies had been looking at doing some joint ventures together -- and Mr. Pether had had a rather interesting conversation a few months earlier with Ekkehard Schulz, ThyssenKrupp's executive chairman. It went something like this.

Dr. Schultz: "You know, Don, I've been thinking. We've been looking at doing business for some time. I like you. I like your company. And I think we'd want to make a bid for Dofasco if someone put you in play by making a hostile run at you -- assuming, of course, you think that's appropriate."

Mr. Pether: "Ekkehard, if we're on the wrong end of a hostile, there's no one I'd rather have as my white knight." Maybe Dr. Schulz consulted Madame Imakamyownlucka, the noted public-company psychic. Maybe it was just fortuitous. All we can tell you is such a conversation actually took place.

In the meantime, Arcelor and Nucor advised Dofasco it could chose from either the group's two previous bids -- one of which was as high as $55.

Mr. Pether telephoned Dr. Schulz to inform him of the hostile bid. Dr. Schulz said he'd call Dofasco back the next day. It's safe to assume he called Mark Trachuk of Osler Hoskin & Harcourt right after hanging up. Mr. Trachuk and Oslers had been working with Thyssen since last summer on making a potential Canadian acquisition.

Mr. Trachuk called in Lorraine Lynds among others at Oslers, while Jonathan White of Citigroup in London and Mary Amor at Citigroup in New York were mobilized to provide financial advice.

The next day, Nov. 17, Dr. Schulz advised Mr. Pether that ThyssenKrupp was interested in making a proposal, and a management team would fly to Toronto for a meeting with Dofasco and its advisers the following day.

Dofasco's special committee informed the full board of ThyssenKrupp's interest, and advised the board that based on the advice of their financial advisers, they were rejecting the revised Arcelor bid.

Dr. Schulz and his team arrived as promised Nov. 18. There were meetings. They went well. Dofasco and Thyssen signed a confidentiality and standstill agreement and Thyssen was given access to non-public financial information.

The board told Arcelor that its bid had been rejected. Later that day, DS advised the board on what it felt would be an appropriate price. Someone, somewhere, among the advisers was also providing advice on what would be an appropriate menu.

The two management teams had a clandestine dinner in one of Oslers' board rooms. No lawyers, no bankers -- and no restaurant. "It had to remain secret," says someone who knows. "They really hit it off. The social dynamics are important in these types of things."

Nov. 21, Dr. Schulz wrote Mr. Pether formally indicating Thyssen was prepared to outbid Arcelor, with a deal that included a $200-million break-fee. Dofasco looked at the offer and told Thyssen it wasn't high enough. At that point, Arcelor was still at the table offering to bid more. The next day, it did.

Nov. 22 Arcelor and Nucor submitted what they said was their "final offer," a complex cash and share deal. What they didn't know is Dofasco already had a higher bid.

ThyssenKrupp, meanwhile, upped its price. Dofasco's board met, reviewed the bids, and decided Thyssen's was clearly better although it felt the break-fee was too high and the price was still too low.

In the wee hours of Nov. 23, we're talking 1 a.m., Arcelor issued a press release going public with an all-cash bid of $56, which was higher than previously indicated. Later that morning, Dofasco got a letter from ThyssenKrupp topping its previous offer, and Arcelor's publicized offer as well.

Dofasco again sent it back, saying it was still too low. Dofasco's board met later that morning and decided the Thyssen offer was approaching the magic number, but directors were concerned the break-fee was too high. The board held a discussion on the risks and benefits of conducting a full auction.

We imagine Dofasco's advisers would have told them that with the company in play, they would be smart to contact other strategic buyers to make sure there were no other interested parties.

The board meeting adjourned. Phone calls were made. The responses were lukewarm at best. When the board met again that afternoon, it was told that Dofasco management and its financial advisers had contacted a number of steel companies and none indicated an immediate or strong desire to enter into significant discussions to buy the company.

Later that day, Thyssen came back at $61.50 plus a lowered $100-million break-fee. The deal looked pretty attractive. Dofasco's board decided to give Thyssen an exclusivity agreement good until Dec. 5 to do due diligence.

Thyssen went in, had a look, and informed Dofasco on Saturday, Nov. 26 that it didn't need until Dec. 5. The company asked Dofasco if it would be ready to sign and announce on the morning of Monday, Nov. 28.

Everyone, of course, had coteries of tax lawyers, competition-law lawyers, and Investment Canada types involved. But the bottom line is the $5-billion deal was drafted, documented and negotiated in five days. And some people wonder why some people have God complexes. . . .

Latest on Stelco

09 December 2005

Vincor - All Hope is Not Lost

Vincor, which has brands such as Inniskillin and Jackson-Triggs, has said a bid between C$39.33 and C$76.14 a share was adequate to gain access to its confidential data.

So, $40 might be a reasonable comeback bid from Constellation in the new year...as I said before, see how the next quarterly results pan out for Vincor.

Current News on Stelco Plan

Stelco offering voters new deal

Steve Arnold

The Hamilton Spectator9 December 2005

The Hamilton Spectator Final

A01Copyright (c) 2005 The Hamilton Spectator.

Intense negotiations have produced a new restructuring plan for Stelco. The latest proposal, the fourth plan this month aimed at ending nearly two years of bankruptcy protection, was approved yesterday by the board of directors. It goes to a vote of creditors today.

Previous plans had tried to satisfy two very different demands from bondholders. First, they wanted cash in addition to new debentures. Then, when a German steelmaker offered $4.8 billion for Dofasco, they demanded new shares that they could sell to any buyer in the market for Stelco.

This plan tries to satisfy both. Under it, Stelco creditors will get a pro-rated share of $275 million in new notes, more than $106 million in cash, 1.1million common shares and the right to draw from a pool of more than 5.6 million new shares which can either be held or sold to equity investors for $5.50 each.

In an interview, Stelco president Courtney Pratt said he's hopeful this version will be the one that finally ends the company's long nightmare by letting creditors choose how they will be paid.

"The changes are very specifically responding to bondholder concerns and give them the opportunity to take shares rather than cash," he said. "They have the option with this plan."

While Stelco's bondholders helped negotiate the newest plan, Pratt said none had committed to supporting it. "Right now, I don't know what the vote will be, but I am hopeful that we'll get a yes vote because we've listened and we've restructured the plan," he said. "I hope these changes will be what's required to get us a yes vote but it's still possible that this plan could be further amended before we take the vote."

Under Stelco's bankruptcy protection, creditors holding two-thirds of its $640-million debt must vote in favour of a restructuring plan which will then be taken to Superior Court Justice James Farley for final approval. Failure to get creditor support could result in a court-ordered sale of the company or a push into receivership by operating creditors if the protection order is not extended at the company's next court appearance on Monday.

Court documents for the sale have been prepared by the United Steel Workers and the motion for a receiver has been filed by Stelco's operating lenders, owed about $217 million.

The pool of new shares to be offered creditors was created by Tricap Management Limited and two investment partners agreeing to give up some of the stake in Stelco they were to get in exchange for lending the company $375 million. Those investors have agreed to buy almost 19.4 million new Stelco shares for more than $106.5 million to prime the pool from which creditors will draw. Any shares left in the pool by creditors will then be purchased by the investors, potentially topping the fund up to $137.5 million.

Elements unchanged from previous plans include paying $400 million toward Stelco's $1.3-billion pension deficit and providing money for new equipment the company says is vital to reducing its production costs. Much of the pension downpayment will come as a forgivable loan of $150 million from the provincial government. Ottawa is also kicking in $30 million for energy projects.

The balance of the pension shortfall will be settled over 10 years with annual payments of $65 million for five years and $70 million for five years starting in the second half of 2006.

Existing shareholders get nothing. Voting on the new plan will be conducted at the International Centre in Mississauga, starting at 10 a.m. In a letter to employees yesterday, Pratt said failure to reach a deal doesn't mean plant gates will be locked immediately and "your wages, benefits and other terms of employment will continue in their current form.

Stelco's directors Wednesday rejected a plan put forward by bondholders. That would have seen Tricap allowed to buy 10 million new shares for $5.50 each. That money would go to creditors along with 15 million shares which senior debenture holders could then buy for $5.50 each. Creditors would also share in $275 million of secured notes and an additional 1.1 million common shares.

If Tricap dropped out of Stelco's refinancing, the bondholders offered to arrange their own package. In another development yesterday, Stelwire workers in Hamilton voted 95 per cent in favour of a deal with the plant's new owner. Stelwire, with plants in Hamilton and Burlington, is one of the subsidiaries being sold by Stelco.

The pact will see the company's Burlington operation close and work consolidated in Hamilton. It includes an early retirement incentive that will allow workers age 55 with 15 years service to leave with a full pension.

"People are happy with this because we're going to restructure and put the business back on its feet," said union president Scott Duvall. "We're sad to be leaving the Stelco chain after 50 years, but we know we have to move on. Settling this will be a real burden off people's minds."