27 October 2005

Research in Motion - Legal Problems

On an interesting note, there were terms of an agreement that was drafted earlier this year, but lacked a meeting of the minds to seal the deal, which includes for licensing arrangements.

So, whats the future hold in store?

I think RIM will bounce back relatively quickly, although not to the same high levels as before. Some analysts are picking target prices of around $62...it will just be a matter of how much NTP will agree to settle for. My guess is a modest premium above the last one, with RIM taking the hit in Q1 2006, so look for improvements after that. RIM will sign quickly, as the technology is partnered with others.

26 October 2005

I'm Back...

Anyways, since the last entry, it has been time to deposit to the cash account, to build up enough for opening an e-trade account. Balance stands at $321, which includes a deposit of $100 CAD, and I found some USD laying around, and added that to it...hence the $321. Every dollar helps!

In other news, Nortel is being played by the profit takers, so it has been up and down around $4 for the past 2 weeks.

I had suggested Stelco, to see if we could get in and speculate the loss of votes for the restructuring plan currently on the table...it hasn't panned out that way yet, and rumour has it that the current plan will yield 66% to creditors (through equity and shares), versus 17-33% if the plan is voted down, and the company left to sell off assets. It is currently at 15 cents. In related news, Mittal paid a premium for the Ukraine state-owned mill, of $4.8 billion, expecting the steel market to rebound from where it is now...as a result, look for low P/E steel stocks to make some ground in Q1 2006. Algoma is holding on to a lot of cash, but hasn't decided what to do with it. Paulson, whose company holds 19%, is asking for a cash dividend, putting pressure on the board to do that. With a low P/E, prices going up in Q1 2006, look for a substantial return on Algoma in the next 6-9 months.

17 October 2005

Nortel is even a better pick now...

Nortel is making some changes at the top...see the article here.

As a result, Nortel closed at 4.10 today...look for big things to happen in the next few quarters.

11 October 2005

Spam Stock Tips....Are They Worth It?

http://www.spamstocktracker.com/

Don't ever think you have missed out on a good trade when you read these emails!

Finding Value in Markets...

Keep in mind, you still need to look at the company in more detail, but the above should weed out a few stocks you may be interested in.

I am looking at a few stocks now, and will blog about them later in the week when I do a little more digging.

10 October 2005

Bankruptcy Details on Stelco...Questions Answered

The great Stelco guessing game

How did we get here? What's at stake? What happens next?

8 October 2005 Copyright (c) 2005 The Hamilton Spectator.

Stelco has teetered on the brink of collapse so many times in the last 20 months, it's almost become routine. In less than two years since the steelmaker sought bankruptcy protection, there have been marathon negotiations, countless court dates, bankruptcy protection extensions and enough lawyers to populate a small country.

Add to that a scant bankruptcy act that leaves those lawyers lots of wiggle room and you have a situation that would confuse even the most brilliant legal or economic mind.

So what's the situation all about and what does it mean? Here's a look at the essential elements of the latest in the steelmaker's fight to get out of bankruptcy.

What is the Companies' Creditors Arrangement Act?

The CCAA is the bankruptcy protection legislation which allows Stelco to put off paying its creditors until it has reorganized.

Unlike its predecessor -- the Bankruptcy and Insolvency Act -- this depression-era legislation is short on strict deadlines and structure.

Why did Stelco seek that protection in the first place?

Stelco CEO Courtney Pratt said the company had no choice. The board of directors said the steelmaker was poised to run out of cash within months. It had lost $168 million in the first nine months of 2003, had a $545-million, long-term debt and was $1.3 billion short of what it needed to cover pension obligations.

Since then, booming steel prices have made unprecedented profits, prompting unions to argue the company wasn't really insolvent in the first place.

Why has the company needed so many bankruptcy protection extensions?

It's not uncommon for companies to get bankruptcy protection extensions but Stelco's 11 extensions have set something of a record.

Steel expert Peter Warrian said this restructuring has been painfully drawn out because of the large number of stakeholders who need to agree. Plus, the University of Toronto professor said, rising steel prices and soaring profits made the situation seem much less dire, sapping any willingness to compromise.

Stelco is poised to request its 12th and, hopefully last, extension Dec. 2. What has the company been doing these last 20 months? Besides requesting bankruptcy protection extensions, the company and its unions have been hard at work -- taking turns bickering, negotiating and shopping around for the best financing deal.

The steelmaker's unions spent the first few months of bankruptcy protection fighting Stelco's insolvency claim in court. When that was rejected, they started negotiating a new collective agreement for Lake Erie workers.

At the same time, both sides searched for a financing deal. After a number of bids, Stelco and its unions settled on the Tricap deal.

What is the Tricap deal?

Under the deal, the province chips in $100 million towards the pension shortfall while Tricap gives Stelco a $350-million renewable loan secured to the steelmaker's assets. Tricap also insures Stelco's attempt to get another $75 million through the sale of secured notes -- IOUs which can be converted into stock.

The deal gives unsecured creditors $225 million in secured notes and $300 million in the form of unsecured notes which can be converted into shares.

In return, Stelco will give Tricap $1.6 million for expenses and pay a $10.75 million "commitment fee" which Tricap keeps if the deal falls through.

Who supports the deal?

Stelco is on board, as are the company's salaried retirees and the unions representing AltaSteel and Lake Erie workers.

Who wants to see the deal killed?

Stelco's largest union, Local 1005 which has boycotted the restructuring negotiations, says the deal poses "enormous risks" and doesn't address the core problems facing the company.

But the bondholders are the deal's most powerful opponents. Bondholders, the steelmaker's largest group of unsecured creditors, are hoping to get a better deal which pays them in hard cash rather than in Stelco stocks.

Who are the bondholders and why do they have so much power?

Bondholders are a mysterious and anonymous group of investors. Sometimes called "vulture capitalists," they often buy up cheap bonds from nervous investors when a company is in trouble.

They then use their influence during the restructuring process to increase the value of their bonds and make a profit. Their influence, in this case, is considerable. Because they make up the majority of the steelmaker's unsecured creditors, they have a deciding vote on any financing deal and could effectively kill it.

The unsecured creditors are scheduled to vote on the Tricap deal Nov. 15.

How does their vote Nov. 15 work?

Every dollar owed equals one vote on Nov. 15. Since $660 million is owed, there will be 660 million votes cast. The bondholders -- with the most money invested in Stelco -- will cast the majority of those votes.

Each of the five companies under the Stelco umbrella will be voted on separately. The votes will be counted by the end of the day. A location for the vote has yet to be determined.

What happens if they vote it down?

It won't be the first time. Bondholders voted down an endorsed deal in the restructuring of Algoma Steel. They were ordered into a hotel with the company, not to emerge until they had a deal. Several days later, they had one.

But if the bondholders vote down the Tricap deal, it will die. Pratt said it would then be up to Farley whether to liquidate the company or have it emerge from bankruptcy without a plan -- neither of which, he said, are good for the company.

What happens if they vote in favour?

Even then, Stelco wouldn't be out of the woods. The deal then goes back to Farley's courtroom. That's when Farley will hear objections to the deal, possibly from shareholders, and decide whether to approve it or not.

In the end, whether Stelco emerges intact or is liquidated rests in his hands.

Could bondholders kill the deal before November?

They are doing their utmost to do exactly that. Bondholders launched a court appeal Thursday, objecting to Farley's tentative approval of the Tricap deal. If the appeal is successful, it will essentially kill the Tricap deal.

What happens to shares and shareholders under this deal?

Stelco shares won't be worth the paper they're written on if this deal is done. Since they are at the bottom of the bankruptcy food chain, they are going to be left with nothing to show for their investment. They could launch a long and expensive lawsuit to recover some of their money but experts say it's a fight they will likely lose.

What role do the unions play?

Unions have a lot of leverage in this restructuring. That's because workers at Lake Erie and AltaSteel both had strike mandates and the renegotiation of their collective agreements became tied to the restructuring process.

Local 1005 is not in the same boat -- because they have a valid collective agreement, they are not in a legal strike position.

While the Lake Erie and AltaSteel locals have a new collective agreement, their members won't vote on their new collective agreement until after bondholders have voted on the Tricap deal.

That essentially gives union members a final say on the restructuring plan, so Stelco will have to keep their interests in mind as it negotiates with the bondholders.

What happens the day after Stelco emerges from bankruptcy?

If all goes well, come Jan. 1 it will be business as usual at the steel mills. But Pratt said Stelco will emerge from bankruptcy a completely different company, free from creditors since it will have paid them all off by the time the bankruptcy protection is lifted. It will have a new board of directors and a new financial plan while its management will remain intact.

How long does it take for a company to get back on its feet?

There can be profit after bankruptcy. Algoma Steel just had its most profitable year in more than a century in business. But it had to go through two major restructurings -- one in 1991 and another in 2001 -- and lay off 600 workers before it hit its stride this year.

It's anyone's guess how long it will take for Stelco to post a profit once it emerges from bankruptcy, but the steelmaker has been making fistfuls of money throughout its bankruptcy protection thanks to a spike in steel prices.

What happens to Hamilton if Stelco doesn't survive?

Hamilton doesn't have its reputation as Steeltown riding just on the survival of Stelco. There are at least 16,000 jobs in Hamilton related to the steelmaking and processing industry. Then there are at least 500 Hamilton companies who deal with the steel industry.

City hall is equally concerned about Stelco's fate. The city's coffers get $10.5 million in taxes from the steelmaker, plus $4.5 million toward education.

08 October 2005

Quick note on Energy stock prices

- energy stock stabilization Friday is going to give a false sense of security of the next little while

And enjoy the Canadian Thanksgiving weekend...:)

06 October 2005

Today's Surprises...

Items of note:

1) HD-DVD and Blu-Ray format wars heating up...both expecting something out in early 2006. Unless Sony can do something with their biz plan, electronics are not attractive right now.

2) Costco and WalMart both looking at higher revenues going into the holiday season

3) Stelco still uncertain, but might be able to scavenge a few dollars if you want to take a chance that the current restructuring plan on the table gets voted down...I predict at least a 20% in value change up, before 15 Nov plan vote (current price $0.26 - look to sell when it hits $0.32)

Market Performance...

05 October 2005

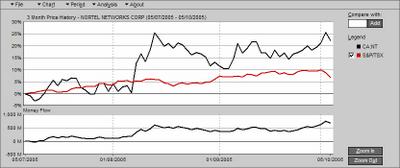

3 Months of Nortel Networks...

This shows a return on investment of 20% in the last 3 months...

This shows a return on investment of 20% in the last 3 months...Just goes to show, that there is money to be made out there...

Pricing Power...

More on riskgrades.com Part 2

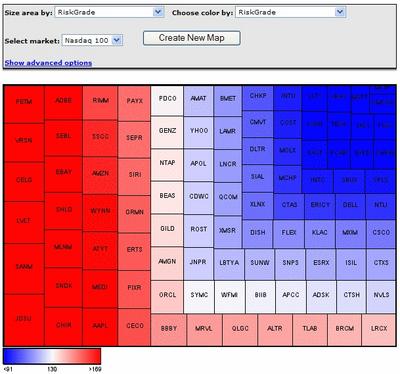

The map above shows the Nasdaq 100 last week. You can get a current snapshot by going to the riskgrades.com site.

More on riskgrades.com...

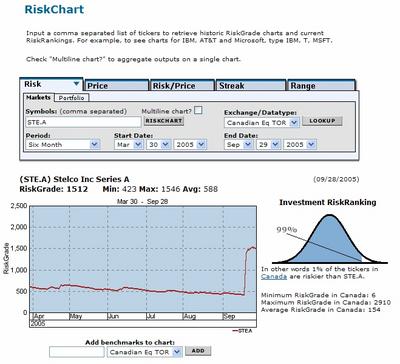

I have looked at a couple of stocks to see how it works. The example below, shows Stelco…

I have looked at a couple of stocks to see how it works. The example below, shows Stelco…

As seen in the chart, Stelco was, and still is, a high risk, due to CCRA proceedings, and the sudden increase in RiskGrade, is when the restructuring plan was presented to the court, which gives existing shareholders nothing in the new company.

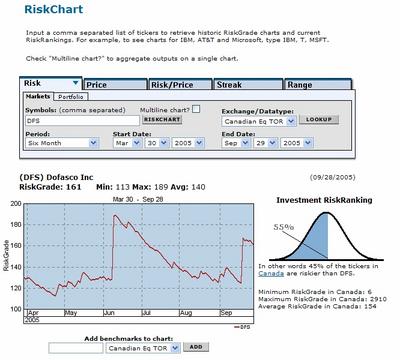

As seen in the chart, Stelco was, and still is, a high risk, due to CCRA proceedings, and the sudden increase in RiskGrade, is when the restructuring plan was presented to the court, which gives existing shareholders nothing in the new company.Another stock I checked, Dofasco, shows how it is less risk, and the change in risk, as advisories and earnings reports are issued.

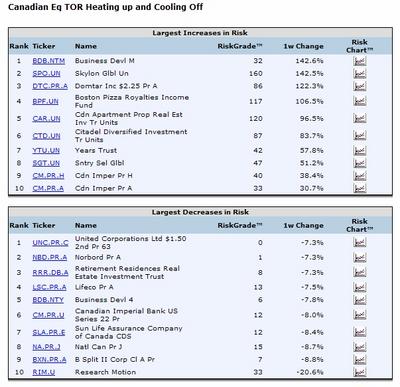

I was also able to pull a clipping off their site, that shows the movers and shakers with respect to risk…the table below shows the biggest weekly changes in risk for Canadian Equities TOR;

I was also able to pull a clipping off their site, that shows the movers and shakers with respect to risk…the table below shows the biggest weekly changes in risk for Canadian Equities TOR;

This kind of information will be key to our success. Feel free to go to the site, and play around with the tools, and get familiar with what's available.

Additional Links...

Usually, when a credit agency downgrades a company’s debt or bonds, this results in a drop in share price, and when looking at the company’s balance sheet and P/E ratio, we can look at the potential return on share value, based on this information.

Some other interesting reading for today:

http://finance.sympatico.msn.ca/investor/investmentbasics/section1/sec1article1.asp

Please note, that I have added a PayPal donation button, to offset the costs associated with developing this site, and research costs.

I will be posting a few blogs today, related to more background information, along with additional links I find relevant.

03 October 2005

The First Step...

1) I had mentioned that 1 Oct 05 was the start date for establishing the savings account for our contributions. I also mentioned that ING Direct has a no-fee investment savings account. At this time, I have established regular biweekly payments into a credit union account for now, starting with the first $200 deposit 30 Sept 05. I will be transferring it to ING Direct, once I set up the deposits to go to ING automatically from my credit union account. The journey has started!

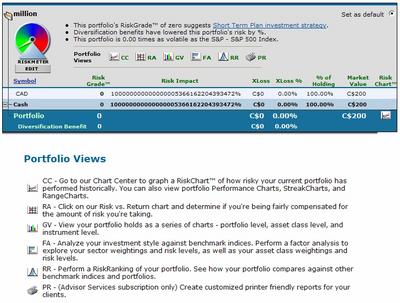

2) I wanted to give more information on the basics of investment strategy, but I have been researching the riskgrades.com site, and find it intriguing. I have set up the portfolio above, and in the next blog, I will give details on how it works, and how it can be a useful tool for capturing risk, and additional information for making our decisions on investing.

** keep in mind, that the tools used above, are only tools. You may wish to use another method of tracking for your investments **

Good luck with your investments!