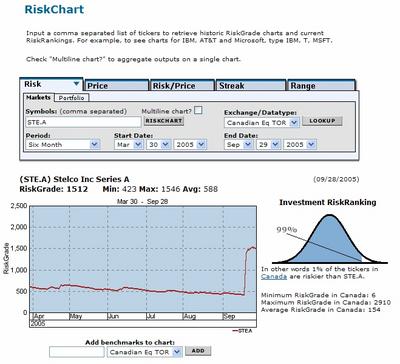

I have looked at a couple of stocks to see how it works. The example below, shows Stelco…

I have looked at a couple of stocks to see how it works. The example below, shows Stelco…

As seen in the chart, Stelco was, and still is, a high risk, due to CCRA proceedings, and the sudden increase in RiskGrade, is when the restructuring plan was presented to the court, which gives existing shareholders nothing in the new company.

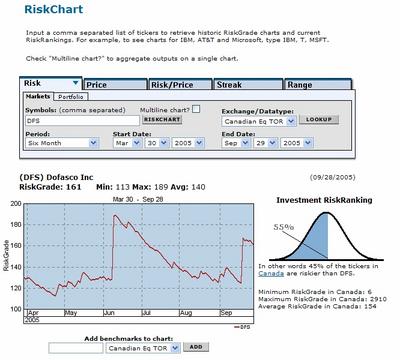

As seen in the chart, Stelco was, and still is, a high risk, due to CCRA proceedings, and the sudden increase in RiskGrade, is when the restructuring plan was presented to the court, which gives existing shareholders nothing in the new company.Another stock I checked, Dofasco, shows how it is less risk, and the change in risk, as advisories and earnings reports are issued.

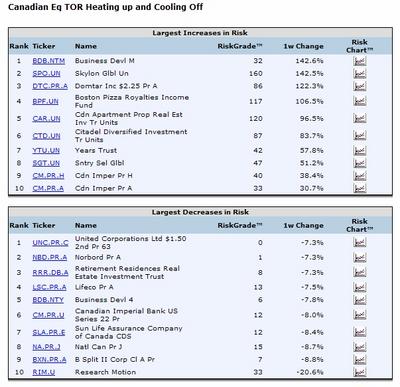

I was also able to pull a clipping off their site, that shows the movers and shakers with respect to risk…the table below shows the biggest weekly changes in risk for Canadian Equities TOR;

I was also able to pull a clipping off their site, that shows the movers and shakers with respect to risk…the table below shows the biggest weekly changes in risk for Canadian Equities TOR;

This kind of information will be key to our success. Feel free to go to the site, and play around with the tools, and get familiar with what's available.

No comments:

Post a Comment