15 December 2006

11 November 2006

Avoiding Stock Scams

Don't give into e-mail from unknown senders who claim it is in your best interest to buy a stock.

By Gerri Willis, CNN

NEW YORK (CNNMoney.com) -- The stock market has been breaking records. And wouldn't you know, scam artists have just come out of the woodwork.

The National Association of Securities Dealers is warning people to watch out for stock scams via e-mail.

1: How it works

So you open your e-mail and find a letter from Chris or Jessica or Fran. The e-mail touts a specific investment opportunity and it seems to have been sent to you in error.

Here's an example of what you may receive: "I was pleased to meet you the other day. The deal I was speaking about yesterday involved a company known as [company name]. It's already heading up, but the big news isn't out yet, so there's still time."

Compelled by your good fortune to receive such a good insider tip, you buy the stock. The price rises because maybe a few people have gotten this same e-mail. But lo and behold, the scammers sell off their shares at this inflated price...and you (and everyone else) is left with worthless stock.

2: Look for the red flags

Usually these e-mails contain misspellings, they're unsolicited. Why would a complete stranger send you an e-mail about a great investment opportunity?

Find out if the stock trades on the Pink Sheets rather than on the New York Stock Exchange or the Nasdaq Stock Market. The stocks on the Pink Sheets don't have to meet as many listing regulatory requirements.

You can go to Nasdaq.com or NYSE.com to see where it trades. Avoid e-mails that encourage you to do something immediately and never trust the "Guarantee." It's anything but.

3: Keep on your toes

Stock scams generally follow the news beat. Right now there are a lot of scams involving energy, oil and gas and ethanol, says John Gannon of the NASD. After Hurricane Katrina, stock scams may have revolved around construction companies or oil stocks.

The bottom line here is that you should never rely solely on information you receive from an unsolicited source - whether it's in the form of an e-mail, a fax, a text message or a phone call.

4: What to Do

If you are suspicious about an offer or if you think the claims might be exaggerated or misleading, contact the SEC Investor Complaint Center at http://www.sec.gov/. You can find out if the firm is registered with NASD by calling the BrokerCheck hotline at (800) 289-9999.

If you've received one of these e-mails, forward the stock spam emails to spam@nasd.com, where they will be reviewed for possible investigation.

08 November 2006

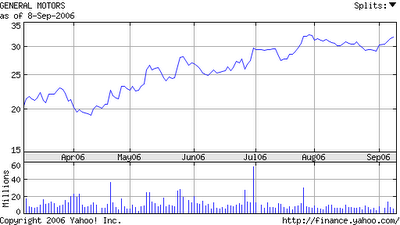

GM Being Smart?

I realize that GM has done some cost cutting, but more needs to be done with the labour and benefit costs. The legacy costs with GM, and the others, will not go away, and will not sit well with consumers.

I would be suprised if they are successful in passing along the increases...GM's stock price won't be doing much, and with analysts giving it a target of $40, I think this is over-optimistic. The overall cost of the vehicle must be reduced, in conjuction with downsizing the production to market share. Wagoner still has a long road ahead, and these issues are not being addressed.

Same will happen with Ford and Chrysler. Toyota seems to be the big buy, as the price gap on vehicles get closer. Look for Toyota to gain with the latest GM pricing.

02 November 2006

Spotting Troubled Companies

Some highlights of the article:

Danger signs include:

-Companies run by family and friends. Sugarman points out that when you have a CFO who is related to the CEO, that's not a good thing - same if the chairman is related to the CEO: "an investor should really start to wonder why, and wonder who is watching the henhouse."

-Companies that go on a buying binges, because if they're doing so great in core businesses, why make acquisitions in other areas?

-Look at Byzantine business structures. As Sugarman says, "if you can't figure out what the heck is going on, and why they need to set something up with such a concentrated fashion, you should assume that there is something that they're trying to hide."

-Listen to skeptics. This chapter features our infamous made-in-Canada mining scandal surrounding Bre-X, the company that in the early 1990s claimed it had discovered a huge gold find in Indonesia. However, the results were fabricated.

Here is the link to the book on Amazon.

17 October 2006

Ebay a Bargain? I Don't Think So...

First and foremost, Ebay has to improve the ecommerce participation rate amongst users. Although there is growth with businesses using ecommerce, there is still a largely untapped market of individual users out there that still are wary of ecommerce. If Ebay can make the big sell to these people, then things might get better for them over the short term. For the longer term, Ebay will have to come up with a better plan to improve growth.

Maybe Meg Whitman is out of steam on this one...I don't see the stock price beating the indices any time soon.

Options Backdating

12 October 2006

Japanese Auto Manufacturing Model - GM & Ford Take Note

This is relevant now, because of the departure of Jerry York from GM's board last week. Now would be a good time to take some of your gains from GM.

Google & YouTube - Value?

I don't think that the price was worth it, because of the nature of the content on YouTube. If Google expects to insert the ads into the videos for revenue, I don't think they will realize the gains warranted by the price paid. With Google involved with YouTube, I can see lawsuits popping up for copyright issues, now that there are deeper pockets associated with it.

Is there something else up Google's sleeve? Datamining is a possibility, to refine their ad targeting, but it still draws upon the current population of surfers to click on ads, and having a video attached, I don't think this will increase their click-through rate. Advertisers may end up paying more for better targeting, but I don't think the effectiveness of the ad-targeting refinement expected, will increase the revenue for the advertisers.

With the robustness of the stock price, I hope I am wrong, for all you individual investors. The scenario of paying too much won't play out for a few months yet.

If Google makes this work, Yahoo and Microsoft will definitely face an uphill battle for on-line ad dollars with their products.

More on Income Trusts

Biggest finding out of the article is that the ratio of distributions paid to cash available for distributions, "has no relationship with the likelihood of cuts".

02 October 2006

Pier 1 - Worth a Look?

I came across this today, which was interesting, courtesy of CNN Money;

PIER ONE: CEO Marvin Girouard says he is stepping down. Not a moment too soon if you ask me. He's been The Man since 1999 and during his tenure, PIR (Charts) went way up and then way down. (From $25 to $7 over the past three years.) They had Kirstie Alley as a pitch person. Then one of the "Queer Eye" guys. They also tried a catalog. Most important though, the company's strategy of importing and selling trendy home furnishings had been copied by the likes of Target (Charts), Wal-Mart (Charts) and others, especially Bombay Company. Still, I think, this one might perk up, now that the big guy is on the way out.

If they could get it together and find something that the public will like, besides wicker furniture, there may be something that can be made...

15 September 2006

Creating Your Own Portfolio

New Search Tool - Relevant to Site Content and Target Group Interests

As always, if the site is useful, please feel free to make a donation with PayPal (top left corner above the swicki) for the site upkeep.

13 September 2006

Telus Conversion to Income Trust

http://www.cbc.ca/story/money/national/2006/09/11/telus-incometrust.html

For a primer on income trusts, go here.

09 September 2006

HP - Can the Stock Price Hold?

These types of messes usually affect the stock price. However, I think that HP will survive the attention. Should Dunn resign? Absolutely...unless it can be shown that she didn't have any knowledge on how the investigation was executed.

I expect Hurd to keep his distance, as he should, and let's hope that the success of the company to date, is not lost, due to illegal investigation methods.

Shame on you, Keyworth!

Ford and Mulally: When Will the Price Be Right?

I would think that in order to gain the confidence of the rest of Ford's employees, a gesture on Mulally's part would be to take less compensation now, and merit bonuses as he turns the company around. That being said, how much faith does Mulally have in his confidence and ability to turn Ford around, if he is taking his money upfront?

If I was a Ford employee, I would seriously consider what might be happening down the road. It would have been in better faith, if Bill Ford made Mulally's compensation dependent on his results...and not give such a hefty upfront signing bonus.

A short time down the road, we will see if things pan out...but I don't think the stock is going up anytime soon, and do what the GM stock did this year.

Stay tuned...I am sure things are going to get interesting in Dearborn towards the end of the year.

Reading Corporate Report Footnotes

http://www.footnoted.org/

Great information to be gleamed from corporate SEC filings and additional information, and how to read corporate reports. I had a look through Michelle's blog, and it's great reading.

06 September 2006

10 Biggest Stocks on Fortune's Fastest Growing List

Top 10 Fastest Growing Small Companies

LaBarge might be considered a good buy right now.

Companies Under Options Investigation

Is Ford Still on it's Way Forward Program?

One can argue points for and against a new leader at Ford, but there are fundamental problems at Ford that need to be addressed, regardless of who is at the helm. I don't think Mulally can pull it off, and having a new leadership team in place won't fix things any time soon. The legacy costs with Ford autoworkers is a fundamental problem within North America, and needs to be part of any new restructuring plan for future survival. The secondary issue, is cars that people want and consider reliable.

I can't help but wonder if any Toyota execs were looked at to come into Ford? Bottom line is, Fords are not selling, and there is an issue with perceived quality and reliability issues with the product lines. The only exception might be the pickups, but, as we have seen, Ford's truck share has also declined with the advent of consumers moving more to cars, and away from the big gas guzzlers of years past.

What Ford needs to do, is spice up its cars, and inject more reliability into its product lines, and above all, reduce overhead and legacy costs. This is about servicing the consumer with a product that is reliable, looks good, and is fun to drive. I have yet to see anything in their lineup that can compete with the likes of the Chrysler 300, except for their reminiscing with the new Mustang Pony edition...this will appeal to the "car guys" only...Ford needs a product that is perceived by the general population, to be a good deal. Hiring Toyota people and sprinkling them within the ranks would be a good start...if anything, perhaps Toyota's culture might rub off onto Ford, and push them into the right direction.

Ford's stock price still has a way to go before it can be considered a "buy"...I expect the stock price to drop even further by the end of the next quarter, as Ford execs work to trim production, and come up with a game plan and new business model. If Ford seriously considers selling a stake in its financial arm, this will provide a big boost to the stock price.

In 2007, perhaps Ford shares can show gains like GM did this year. Ford will be worth watching, as changes start to happen by the end of the year. Although Mulally may not have been my first choice, I wish him well.

17 August 2006

Ebay Entrepreneur? Why Not!

Current Stock Watch

15 August 2006

Blog Updating...Stay Tuned!

Be back soon with more exciting discussions, and a visually appealing blog!!

14 May 2006

Current Stock Watch - 14 May 06

Gold - Can Money Still be Made?

OptionsXpress

Open an Account Learn More Site Tour

Attention Traders:Trade stocks, options, energy, metal and currencies from one account!

Interested in trading futures? Now you can, from the same account you trade stocks, bonds, mutual funds & options!

optionsXpress now offers:

Financial Futures

Currency Futures

Metals

Interest Rates

SSF's1

Energy Futures

See details

Keep all your investments, securities & futures in one convenient account.

Our futures trading screens are easy to use, and feature advanced order capabilities you won't find at many online brokers.2 Learn more about our feature packed trading platform.

Want to start trading? Open an optionsXpress account now and learn how you can enable futures trading >

Would you like to learn how to trade futures without putting your money on the line? When you sign up for an optionsXpress account you'll be able to use our Virtual Trade platform to practice trading Futures!

Stelco First Quarter Results - Q1 2006

The results reported today include a $43 million after-tax loss on discontinued operations which represents the businesses of the Mini-mill and Manufactured Products segments, the sales of which were completed in the first quarter. As well, reorganization costs on a pre-tax basis in each of the first quarters of 2006 and 2005 amounted to $21 million compared to $29 million in the fourth quarter of 2005.

The following information excludes discontinued operations.

Net sales revenue in the first quarter of 2006 was $674 million compared to $728 million for the same period in 2005. This 7% decrease was mainly due to renewal of customer contracts at lower prices and lower spot market prices, a lower value-added mix as a result of the fourth quarter 2005 Lake Erie Steel's hot strip mill outage and the negative impact of the higher Canadian dollar.

Cost of sales for the first quarter of 2006 was $695 million compared to $593 million for the same quarter of 2005. This 17% increase was primarily due to higher spending for repairs and maintenance, purchased services and supplies; higher natural gas, coal, ore and zinc costs; the flow through of high cost inventories produced in the previous quarter; and the impact of the fourth quarter 2005 Lake Erie Steel's hot strip mill upgrade, which included the high cost of outside conversion of slabs to hot roll coils. These costs were partly offset by lower purchased coke, scrap and electricity costs; a lower value-added mix of sales, and reduced labour costs at Hamilton Steel, resulting from the continued attrition of the workforce.

Production in the first quarter of 2006 was 997,000 semi-finished net tons compared to 1,020,000 semi-finished net tons produced during the same period in 2005. Shipments during the first quarter of 2006 totaled 974,000 net tons compared to 907,000 net tons shipped during the first quarter of 2005, representing a 7% increase.

As of March 31, 2006, the net liquidity position of the "Predecessor" company was $250 million, consisting of $36 million of cash, cash equivalents and restricted cash, $396 million of available lines of credit, less $182 million of drawings on credit lines. This compares to net liquidity of $304 million for the same period of 2005, and $254 million for year-end 2005. The net liquidity position for the "Successor" company, as of March 31, 2006 was $555 million, consisting of $36 million of cash, cash equivalents and restricted cash, $946 million of available lines of credit, less $427 million of drawings on lines of credit.

The $305 million increase in net liquidity from the Predecessor company to the Successor company, is the result of the following events in connection with the implementation of the CCAA Plan.

You can read additional information here. Stelco is not a healthy choice right now...

06 April 2006

Stelco Ticker...and Interesting Information

More bad news on Nortel here. Things will pick up.

Nice to see Vincor gain the value I predicted, on Constellation takeover. See previous posts.

02 April 2006

Stelco Back in the Game

Starting out at $5.50, the shares will drop when Q1 2006 results come out, making the major owners want to sell off the business units to hedge their investments. Keep in mind too, that Stelco won't be paying any dividends for the next 10 years, if they don't shut down again under heavy debt and obligations.

I'll post the ticker symbol when its available. If you want steel stock, stick with Corus or AK.

31 March 2006

Pension Accounting Changes

30 March 2006

IPOs - Interesting Information

29 March 2006

AK - Next Takeover Target? Other Odds and Ends...

I was hoping that the Alcatel and Lucent deal might have a bigger impact on Nortel. I can't see Nortel having any more issues with its finances. Now, can we get above $4? Soon?

Vincor is steadily moving upwards...maybe Constellation will come back by the end of June for another look.

Stelco is looking to come back to the TSE at the end of the week. Not sure what the listing and when, but I will post here when it comes out.

Wendy's will be spinning off the rest of Tim Horton's by the end of the year. With a price of about $30 now, it's worth it to get some now, and hold onto it until the end of the year.

27 March 2006

Corus Steel

Corus's shares rose 9 1/2p to 94p yesterday. The shares have climbed more than 50 per cent this year, making it the best performer in the FTSE 100 index. Neither Corus nor Evraz have commented on the merger talks.

Also, Tim Horton's ticker and follow the stock price...THI.TO. Consider Wendy's as an investment, to capture gains on the 85% they sell by the end of the year.

23 March 2006

Tim Horton's IPO - $23.16 a share

21 March 2006

20 March 2006

Tim Horton's IPO - Coming Thursday, 23 Mar 06

NOTE: WENDY'S HAS INCREASED THE SHARE PRICE IN THE OFFERING TO $25-27 PER SHARE...IF YOU CAN GET YOUR HANDS ON SHARES, IT WILL BE WORTH IT IN THE SHORT TERM (added 21 Mar 06).

19 March 2006

Tech Stocks

Here is an interesting "expose" on Google, by Phil. Lots of interesting information. There are a few posts related to Google's performance that are worth reading.

18 March 2006

11 March 2006

Cheap Beer

With the "cheap beer" wars, with everyone jumping into the "buck a beer" foray, there will be winners and losers...Winner? Lakeport Brewing Income Fund. Results so far have been great, and details of the latest results can be seen here. Congratulations to Teresa Cascioli, and her team. Loser? Sleeman. Results so far show that it's not doing too well in the beer wars. Their strategy to compete in the "buck a beer" battle is backfiring, when they are known, and were known, as a premium branded beer. Sleeman needs to get back to the premium image it based its growth on, a few years ago.

A Little on the Steel Situation

AK Steel - While in the middle of a labour dispute, key market for AK is automotive. If TK doesn't get Dofasco, I think AK/TK would be able to form a synergistic entity to hold its own against Mittal's ISG group (it's US interests). I believe that AK is the current NA frontrunner for a takeover. AK could strengthen TK's stainless portfolio, and give TK a larger presence in NA for automotive, which it was looking for with Dofasco.

Algoma Steel - With the recent announcement of the $200 million special dividend, this is enough of a "fix" to get Paulsen off Turcotte's back for a bit. Problem is, a drop in steel prices of about 10%, will spell trouble for Algoma. It needs the cash in the bank to weather the next turndown. Turndown won't be that bad, but, shareholders will be knocking at the door for returns.

Stelco - This is a tough one -- New equity holders have done the right thing to split up the business into 9 units. The jewel of Stelco is Lake Erie works. Look for someone to show interest and offer something for Lake Erie works to speculate on the increased need for flat rolled to supply Toyota and Honda. Who will be the suitor? My guess is Nucor may be looking around, or even TK.

Vincor - Trundling Along

Laurentian Bank

On a personal note, I deal with RBC Insurance, and they offered the best auto rates, and house insurance. What better business synergy can you get? Banks increasing your service charges, but decreasing your premiums, because the bank network model works well for insurance sales.

RIM - Problems Finally Solved

THI - Tim Horton's IPO

11 February 2006

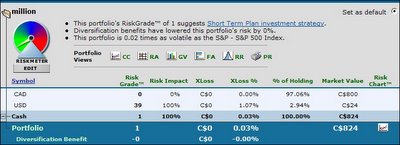

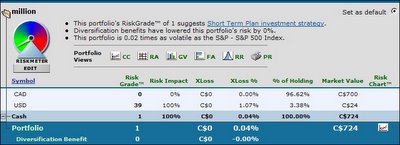

Current Account Balance - $824 CDN

Thoughts on Some of My Watch List

LaBarge has been on my radar screen for a while now. It's shown positive movement in the last 4 months or so. Check them out as an investment for this year.

Vincor is making a slow comeback after fending off the bid from Constellation. I see them hitting $35 by year end.

30 January 2006

Current Watch List

There has been alot of action around Dofasco and Arcelor these days. It would seem that steel stocks are in play, for consolidation of the industry. Given the fact Mittal has made a hostile bid for Arcelor, size doesn't seem to matter. Given that, here are a couple of good buys based on what I have seen;

Corus Group - A marriage of British Steel and Hoogovens, the company has had its share of problems while the bugs were being worked out. Although they still have some fundamental problems, with the current wave of consolidation, Corus looks like it could be a target for someone like Mittal. The question is whether Nippon Steel, being 3rd ranked overall, will they stay there, or will they go on a buying binge? I think news that Corus is being stalked might come out in the 6 months. Worth looking into.

AK Steel - This is a quandry. With the recent results from Nucor, showing an 11% increase over last year, AK should be doing better. I figure AK will go down lower in the next 6 months, based on steel price outlook, and with the Big 3 auto companies cutting back, AK will be hardpressed to show good results. However, with Mittal's style of picking up bargains, I figure the stock will drop mid 2006, and look for someone to come in and steal AK. If the Mittal/Arcelor bid is unsuccessful, then Mittal will turn his sights to some other commodity steelmaker - AK is strip, but Mittal may not be able to pass up a bargain. Auto business should pick up late 2006, and AK might be able to scoop some profits.

I have been lax in writing this blog recently. I will be catching up on some specific financial news this week, and get caught up with the action in the market. I'll also have some comments on the stocks on my watchlist. Stay tuned.

15 January 2006

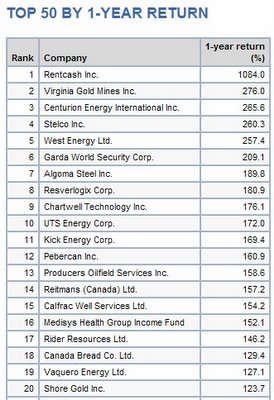

Top Returns for Canadian Companies - 2005

I pulled off the breakdown by large, mid, small cap returns;

I pulled off the breakdown by large, mid, small cap returns;

Let's hope for the same returns and opportunities for 2006.

09 January 2006

Stelco provides restructuring update

More news on Stelco...it should be interesting to see what the creditors do with respect to shares and cash.

HAMILTON, ON, Jan. 9 /CNW/ - Stelco Inc. (TSX:STE) today issued an updateon various measures being pursued under its Court-supervised restructuring process. The update is designed to, among other things, provide information that will assist affected creditors in electing whether to receive all or anypart of their distribution from the cash pool in new common shares of Stelco, rather than cash, as part of the recovery provided under the restructuring plan approved by affected creditors on December 9, 2005. The Company indicated that election forms were delivered to all in recent weeks. Under the restructuring plan, each affectedcreditor may elect, no later than 5:00 p.m. (Eastern time) on January 16,2006, to receive all or any part of its distribution from the cash pool in new common shares, subject to an overall limit on the number of new common shares that creditors collectively can elect to receive. Any affected creditor whodoes not so elect will receive its entire distribution from the cash pool in cash. Stelco also confirmed that the Court will consider the restructuring plan approved on December 9, 2005 at a sanction hearing on January 17, 2006. At that time the Court will also hear an application by certain existing shareholders seeking the sale of the entire Stelco enterprise as a going concern. Stelco does not believe that such a course would be in the best interests of the Company and its stakeholders. The Company also reported that the process of identifying a new board ofdirectors is continuing. The Company's agreement with the three significant equity holders provides that the new board will consist of: four directors to be named by Tricap Management Limited, one director to be named by each of Sunrise Partners Limited Partnership and Appaloosa Management LP, and the remaining three directors to be satisfactory to the three significant equity holders as a group. It is expected that the composition of the new board will be announced shortly before the date of the sanction hearing. Stelco also announced that the three significant equity holders, whotogether will hold a majority of shares in the Company upon completion of the restructuring, have indicated their desire that Courtney Pratt, the currentchief executive officer of the Company, be named chairman of the new board of directors, and that the Company seek a new chief executive officer. Any such changes are dependent upon plan implementation, scheduled for the end of February 2006.

08 January 2006

Christmas Holidays are Over...Back to Posting

Stay tuned for more postings over the week.