Well, as I predicted, a white night came along...one of the 2 I was thinking that would. ThyssenKrupp is a German steelmaker, came in with a bid of $61.50... a little short on the $64 I thought Dofasco might get, but trading hit $63.90 on the TSX. Maybe Arcelor will sweeten the bid, but the sound of the board, it looks like a done deal.

Vincor is holding fast, expecting the shareholders to reject Constellation's current offer of $35. I still think they will come back in the new year. I will follow the run until Q4 2005 reports, and see if it will be a possible buy at $40 for Constellation.

28 November 2005

27 November 2005

Thoughts and Comments for the end of November

Its been a quiet few days, due to US Thanksgiving. Here are a couple of things for Monday;

* Stelco vote tomorrow on the restructuring plan. Look for the stakeholders to accept it as is, and wipe out the common shares. More on when they come out of restructuring in January, as to whether they will be a good buy.

* Sony is having its problems. I still maintain that in Q1 2006, it will be depressed, and with news that Microsoft is selling Xboxs at a loss (software is the money maker), Sony should bounce back on the announcement of PS3 coming out. I heard that the PS3 can play any game on disk...if thats true, there may be more people lining up to buy those than the Xbox, due to older game inventories on the homefront.

* A while back, I mentioned that Walmart would be a big winner this season. Numbers out so far show that they did well this weekend, and will gain momentum over the holidays. I still think they will beat expectations next report. Overall shopping in the US was expected to be 22% better than last year.

That's all for now. Congrats to Edmonton on winning the Grey Cup!

* Stelco vote tomorrow on the restructuring plan. Look for the stakeholders to accept it as is, and wipe out the common shares. More on when they come out of restructuring in January, as to whether they will be a good buy.

* Sony is having its problems. I still maintain that in Q1 2006, it will be depressed, and with news that Microsoft is selling Xboxs at a loss (software is the money maker), Sony should bounce back on the announcement of PS3 coming out. I heard that the PS3 can play any game on disk...if thats true, there may be more people lining up to buy those than the Xbox, due to older game inventories on the homefront.

* A while back, I mentioned that Walmart would be a big winner this season. Numbers out so far show that they did well this weekend, and will gain momentum over the holidays. I still think they will beat expectations next report. Overall shopping in the US was expected to be 22% better than last year.

That's all for now. Congrats to Edmonton on winning the Grey Cup!

25 November 2005

Updated Portfolio - November 2005

Just a quick update of the status of the cash account...

Still all cash, until the new year, and then I'll make the move over to an e-trade account.

Stelco Restructuring Plan

Looks like the restructuring plan for Stelco has been approved in principle with all stakeholders. Nothing for existing shareholders, so that was a bust. HOWEVER, even with everyone on board, Stelco is going to have a hard time making money when it comes out of bankruptcy in Jan 2006. We'll look at Stelco at the end of Q2 2006, to see if the new and improved Stelco is worth hedging for the last half of the year. Stay tuned. I figured that the governments would kick in $100 million to seal the plan - they ponied up $80 million...pretty good guess.

Note - the pension contribution holiday ends after 6 months after restructuring...so, look for charges of $30-$35 million against each of the Q3 & Q4 next year. We need to see the IPO of the new shares in Jan before we can crunch the numbers. Remember also, that GM just renewed the contract with Stelco, BEFORE it announced the plant closures.

Note - the pension contribution holiday ends after 6 months after restructuring...so, look for charges of $30-$35 million against each of the Q3 & Q4 next year. We need to see the IPO of the new shares in Jan before we can crunch the numbers. Remember also, that GM just renewed the contract with Stelco, BEFORE it announced the plant closures.

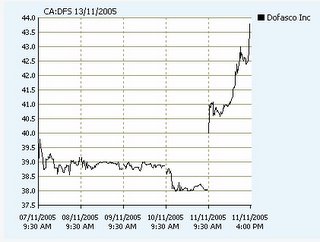

Dofasco Under Attack

News out on Wednesday, Arcelor put an offer out to the shareholders at $56...this was overdue. Dofasco has been a prime target for over a year, so it was just a matter of time. Of interesting note, was this excerpt from S&P the day of the announcement;

TORONTO (Standard & Poor's) Nov. 23, 2005--Standard & Poor's Ratings Services today said it placed its 'A-' long-term corporate credit and senior unsecured debt rating on Dofasco Inc. on CreditWatch with negative implications after Luxembourg-based Arcelor S.A. (BBB/Stable/A-2) announced a C$4.3 billion unsolicited cash offer for the company's shares. The CreditWatch stems from the likelihood that the ratings on Dofasco would be lowered two notches to be equalized with those on Arcelor if the transaction is completed.

My guess is that there will be someone else that comes into the picture and makes a grab for Dofasco. If I had to guess, Gerdau SA (or TK) might come in as white knights and compete. I think that it will be sold at $64, with QCM included.

TORONTO (Standard & Poor's) Nov. 23, 2005--Standard & Poor's Ratings Services today said it placed its 'A-' long-term corporate credit and senior unsecured debt rating on Dofasco Inc. on CreditWatch with negative implications after Luxembourg-based Arcelor S.A. (BBB/Stable/A-2) announced a C$4.3 billion unsolicited cash offer for the company's shares. The CreditWatch stems from the likelihood that the ratings on Dofasco would be lowered two notches to be equalized with those on Arcelor if the transaction is completed.

My guess is that there will be someone else that comes into the picture and makes a grab for Dofasco. If I had to guess, Gerdau SA (or TK) might come in as white knights and compete. I think that it will be sold at $64, with QCM included.

22 November 2005

Vincor - Can a Friendly Deal Be Done?

Vincor has taken its poison pill off the table, figuring that the shareholders will reject the current offer from Constellation Brands ($31). Current closing price is $34.80...look for Constellation to make another bid, paying a premium (20%?? - $6) over the current price. Of course, being the holiday season, this Q will show the numbers to support $40 or $41 offer price from Constellation (just a hunch...).

Stelco is still without a plan, with a current vote expected tomorrow. The only thing that will get everyone on-board will be another $100 million from the government...will they cave and give in? Maybe there is a creative way the government can come to the table, given the incentives coming down for the Big 3 auto.

RIM, closing down to $78.88, I still support the $62 target...

Disney is another up and comer to watch...stay tuned to see what happens with Pixar, and the lineup for the movies for 2006. They are off to a good start...look for earnings to beat the street.

Stelco is still without a plan, with a current vote expected tomorrow. The only thing that will get everyone on-board will be another $100 million from the government...will they cave and give in? Maybe there is a creative way the government can come to the table, given the incentives coming down for the Big 3 auto.

RIM, closing down to $78.88, I still support the $62 target...

Disney is another up and comer to watch...stay tuned to see what happens with Pixar, and the lineup for the movies for 2006. They are off to a good start...look for earnings to beat the street.

19 November 2005

Update - Miscellaneous

Just a few odds and ends this post;

* GM has sunk to a new low this week, which is making it attractive, if they can turn things around. Having a smaller market cap makes it an ideal takeover target, except for the $77 billion liabilities. Kerkorian might have some ideas in the weeks and months ahead.

* Stelco problems are continuing, with no vote yet. Monday (21 Nov) is the new date, and if the bondholders don't get on board, look for the provincial government to step in and increase their contribution.

* Here is my current "watch list" of stocks;

* GM has sunk to a new low this week, which is making it attractive, if they can turn things around. Having a smaller market cap makes it an ideal takeover target, except for the $77 billion liabilities. Kerkorian might have some ideas in the weeks and months ahead.

* Stelco problems are continuing, with no vote yet. Monday (21 Nov) is the new date, and if the bondholders don't get on board, look for the provincial government to step in and increase their contribution.

* Here is my current "watch list" of stocks;

Be sure to check back on a regular basis, as I keep tabs on what's happening in the markets.

15 November 2005

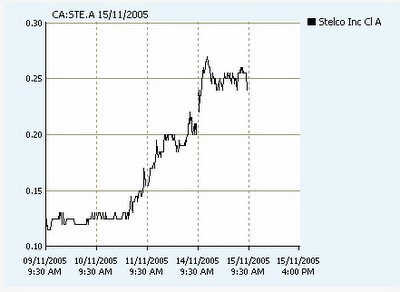

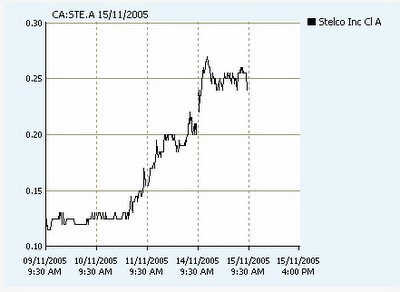

Stelco D-Day

Reviewing the action on Stelco, the chart below says it all;

Since the end of last week, Stelco has garnered almost 100% in value, of course, on the premise that the current restructuring plan will be voted down by bondholders. Stay tuned, lets see if we can get the 6 cents we were looking for a few weeks ago.

Since the end of last week, Stelco has garnered almost 100% in value, of course, on the premise that the current restructuring plan will be voted down by bondholders. Stay tuned, lets see if we can get the 6 cents we were looking for a few weeks ago.

13 November 2005

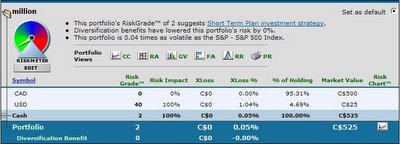

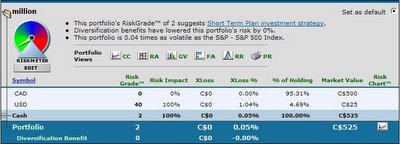

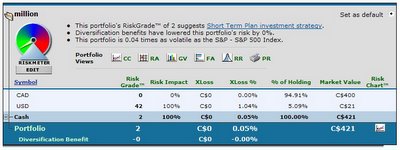

Updated portfolio

The following is a screen shot of my current portfoilio;

Look for better gains towards the end of the year, and reporting of Q4 results in Jan 2006, with DFS and the QCM units.

As we had discussed before, current holdings are cash, until there is enough (min. $500 to open an e-trade account)...looks like the target date for opening the account will be Jan 2006...stay tuned.

In other news, Dofasco climbed 13% on the day, on news of creation of an income trust for its QCM holdings.

Look for better gains towards the end of the year, and reporting of Q4 results in Jan 2006, with DFS and the QCM units.

11 November 2005

Explanation of Income Trusts

Income trusts are the latest craze, and Dofasco has spun off QCM into one. Check out Wikipedia explanation on income trusts.

Vincor Being Stalked

Latest news is Constellation Brands is looking to pick up Vincor, with the value being pegged at about +20% from the current value ($34.81)...might be worth looking into getting a few shares to cash in on the acquisition. More, if they pay a premium.

10 November 2005

Odds and Ends

A couple of things tonight to note...Stelco shares jumped 16%, from 13 cents to 16 cents, probably on the pending news of the restructuring plan being voted down...on that note, Stelco lost $42 million this quarter. Keep in mind that even when they come out of restructuring, the price of steel won't be able to sustain Stelco's proposed restructure. Look for losses for quarters to come, until there are some concessions from the union.

Nortel is down a bit...it will bounce back...

Nortel is down a bit...it will bounce back...

09 November 2005

Nortel Status

Nortel is still up and down this week...hopefully it gains momentum over the next 6 weeks...click here for the latest chart.

The Next Big Techs?

Here is an excerpt from FSB with respect to a business plan competition and how startups rated.

I like the idea of a gaming card that compensates for lag. This would be a cheaper alternative to people out there with older PCs that don't want to spend the money on a faster computer...just a thought...

On the Stelco front, bondholders are holding their ground about vetoing the restructuring plan, and the shares moved up 13% today (11 cents to 13 cents on the TSX), with debentures dropping down 6%...CEO Pratt will have to work wonders to get everyone on board. Big vote is scheduled for 15 Nov....stay tuned.

I like the idea of a gaming card that compensates for lag. This would be a cheaper alternative to people out there with older PCs that don't want to spend the money on a faster computer...just a thought...

On the Stelco front, bondholders are holding their ground about vetoing the restructuring plan, and the shares moved up 13% today (11 cents to 13 cents on the TSX), with debentures dropping down 6%...CEO Pratt will have to work wonders to get everyone on board. Big vote is scheduled for 15 Nov....stay tuned.

05 November 2005

The Next Tidal Wave in Advances

I was reading Business Week Online, and came across an interesting article...and excerpt is below;

Today, the signs around us are just as difficult to read, but, as Yogi Berra once remarked, "You can see a lot just by looking." What will be the next half-century's all-transforming technology? And who will reap the riches to become the next Bill Gates?

SIGNS OF CHANGE. I believe the answer lays in the confluence of three heretofore largely separate trends:

• The evolution of semiconductor-manufacturing capabilities and products into nanoscale dimensions.

• The increasing ability of biochemists to engineer genetic material at the molecular (nano) level.

• The exponential growth of computer simulations permitting the design of clusters of atoms at the nano dimension.

For decades, each trend evolved separately. But today, these trends have come together, amplifying each other's capabilities and forming the nucleus of what I call the 3N revolution.

SIZZLING SYNERGIES. Why these three trends?

First, they are each attracting huge numbers of very smart scientists and engineers from around the world -- and one should never underestimate the potential of combined intellectual horsepower.

Second, all three trends are already beginning to overlap in highly productive ways. The gene chips from a company like Affymetrix rely on semiconductor processing in their manufacture, new materials are now made directly in the computer rather than empirically on the lab bench, and the Human Genome Project depended as much on high-speed numerical analysis as on wet chemistry.

Today, the signs around us are just as difficult to read, but, as Yogi Berra once remarked, "You can see a lot just by looking." What will be the next half-century's all-transforming technology? And who will reap the riches to become the next Bill Gates?

SIGNS OF CHANGE. I believe the answer lays in the confluence of three heretofore largely separate trends:

• The evolution of semiconductor-manufacturing capabilities and products into nanoscale dimensions.

• The increasing ability of biochemists to engineer genetic material at the molecular (nano) level.

• The exponential growth of computer simulations permitting the design of clusters of atoms at the nano dimension.

For decades, each trend evolved separately. But today, these trends have come together, amplifying each other's capabilities and forming the nucleus of what I call the 3N revolution.

SIZZLING SYNERGIES. Why these three trends?

First, they are each attracting huge numbers of very smart scientists and engineers from around the world -- and one should never underestimate the potential of combined intellectual horsepower.

Second, all three trends are already beginning to overlap in highly productive ways. The gene chips from a company like Affymetrix rely on semiconductor processing in their manufacture, new materials are now made directly in the computer rather than empirically on the lab bench, and the Human Genome Project depended as much on high-speed numerical analysis as on wet chemistry.

03 November 2005

More on Stelco's Situation

Interesting article on Stelco situation...

Court deliberates over Stelco

by Laura King in Toronto3 November 2005

TheDeal.com Copyright 2005, The Deal, LLC. All Rights Reserved

The Ontario Court of Appeal has reserved its decision on whether to throw out two financing deals that form the crux of the restructuring plan for insolvent steelmaker Stelco Inc.

The three-judge panel said Wednesday, Nov. 2, it will rule promptly, but Stelco CEO Courtney Pratt said the company must make changes to the restructuring plan to satisfy the bondholders who oppose the deal.

Meanwhile, Stelco announced that it is selling three of its units to Mittal Steel Co. NV. Stelco creditors are to vote on the its restructuring plan on Nov. 15 but a group of bondholders, including some U.S. hedge funds, say they'll veto it.

The group opposes two deals included in the plan. The restructuring plan requires approval by creditors holding at least two-thirds of the money owed, or about C$640 million ($545 million).

"We shouldn't kid ourselves,'' Pratt said outside court. "This plan is not going to get accepted.'' Stelco has been under creditor protection since January 2004. Justice James Farley of the Ontario Superior Court approved its restructuring plan on Oct. 4. It includes a deal with the Ontario government for a C$100 million loan that is contingent on Stelco making a C$400 million down payment on its C$1.3 billion pension solvency deficit, which the bondholders say is excessive. Under that deal, $75 million of the C$100 million loan can be forgiven and the province could end up owning 8% of the Stelco.

A second deal calls for Brascan Corp.'s Tricap Management Fund to provide C$450 million in financing but the bondholders say fees associated with the deal are too high. The bondholders say Stelco didn't actively seek competing proposals.

Tricap could end up with a multimillion dollar breakup fee if the deal collapses. Lawyers for bondholders argued Wednesday that Farley shouldn't have approved the restructuring plan knowing that the bondholders intend to vote against it.

Bondholders would be paid about 66 cents on the dollar under Stelco's restructuring plan, which would be more than creditors of Bethlehem Steel Corp. and other U.S. steelmakers received after restructuring. Stelco shareholders would end up with nothing.

Stelco is aiming to exit creditor protection by Dec. 31. Stelco said it has signed a letter of intent with Mittal and that the sale hinges on the negotiation of a definitive agreement. It didn't disclose a price for the sale of Norambar Inc. in Contrecoeur, Quebec, Stelfil Ltée. in Lachine, Quebec, and Stelwire Ltd. in Ontario.

Stelco announced early in its restructuring process that it would sell the divisions, which it considers noncore, in order to focus on its integrated steel business.

Court deliberates over Stelco

by Laura King in Toronto3 November 2005

TheDeal.com Copyright 2005, The Deal, LLC. All Rights Reserved

The Ontario Court of Appeal has reserved its decision on whether to throw out two financing deals that form the crux of the restructuring plan for insolvent steelmaker Stelco Inc.

The three-judge panel said Wednesday, Nov. 2, it will rule promptly, but Stelco CEO Courtney Pratt said the company must make changes to the restructuring plan to satisfy the bondholders who oppose the deal.

Meanwhile, Stelco announced that it is selling three of its units to Mittal Steel Co. NV. Stelco creditors are to vote on the its restructuring plan on Nov. 15 but a group of bondholders, including some U.S. hedge funds, say they'll veto it.

The group opposes two deals included in the plan. The restructuring plan requires approval by creditors holding at least two-thirds of the money owed, or about C$640 million ($545 million).

"We shouldn't kid ourselves,'' Pratt said outside court. "This plan is not going to get accepted.'' Stelco has been under creditor protection since January 2004. Justice James Farley of the Ontario Superior Court approved its restructuring plan on Oct. 4. It includes a deal with the Ontario government for a C$100 million loan that is contingent on Stelco making a C$400 million down payment on its C$1.3 billion pension solvency deficit, which the bondholders say is excessive. Under that deal, $75 million of the C$100 million loan can be forgiven and the province could end up owning 8% of the Stelco.

A second deal calls for Brascan Corp.'s Tricap Management Fund to provide C$450 million in financing but the bondholders say fees associated with the deal are too high. The bondholders say Stelco didn't actively seek competing proposals.

Tricap could end up with a multimillion dollar breakup fee if the deal collapses. Lawyers for bondholders argued Wednesday that Farley shouldn't have approved the restructuring plan knowing that the bondholders intend to vote against it.

Bondholders would be paid about 66 cents on the dollar under Stelco's restructuring plan, which would be more than creditors of Bethlehem Steel Corp. and other U.S. steelmakers received after restructuring. Stelco shareholders would end up with nothing.

Stelco is aiming to exit creditor protection by Dec. 31. Stelco said it has signed a letter of intent with Mittal and that the sale hinges on the negotiation of a definitive agreement. It didn't disclose a price for the sale of Norambar Inc. in Contrecoeur, Quebec, Stelfil Ltée. in Lachine, Quebec, and Stelwire Ltd. in Ontario.

Stelco announced early in its restructuring process that it would sell the divisions, which it considers noncore, in order to focus on its integrated steel business.

01 November 2005

Top Stocks to Watch - CNN Money's Sivy's 70

CNN Money has a few good newsletters that come out, that provides some understanding as to what is happening in the market that day. Also, Sivy is one of the correspondents, and he has done an excellent job of listing the top 70 stocks of major players, which he thinks will provide above market average growth in the long term.

Nortel clears last hurdle, we hope

Nortel and Motorola have settled their lawsuit for the new CEO. Q3 results will be posted on Wed. Last closing price was $3.81.

Subscribe to:

Posts (Atom)