One of the things that caught my eye in the news, and particularily the stock market was the review of the top stocks in the country, for annual returns. Every year, there are a handful of stocks that return in excess of 100% in one year. The trick, of course, is to find them! What really got me, was the fact that some stocks, even in the waning industries, like steel, were even returning 600% over a year (Algoma) for 2003-2004. There is no reason that common sense can’t dictate a conservative return of at least 100% over a year, given market performance in some sectors over the past few years.

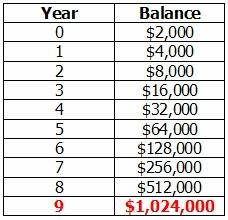

One of the things that caught my eye in the news, and particularily the stock market was the review of the top stocks in the country, for annual returns. Every year, there are a handful of stocks that return in excess of 100% in one year. The trick, of course, is to find them! What really got me, was the fact that some stocks, even in the waning industries, like steel, were even returning 600% over a year (Algoma) for 2003-2004. There is no reason that common sense can’t dictate a conservative return of at least 100% over a year, given market performance in some sectors over the past few years.Granted, there are risks…but the idea is that the money that we save, we know we want to be aggressive with it, and make the most we can for it. For a mere $200 every 2 weeks, there is a cushion in our principal investment, from the table above. If we were to take the total time frame above, and figure what our principal would be over this time, the total is 26 deposits x $200 x 9 years = $46,800. Keep in mind that I will be using my $200 contributions in this blog. Feel free to reduce or increase your contributions accordingly.

Back to my situation. I am a separated male, 42 years old, and my background is in engineering, not finance. I pay child support, I don’t work paid overtime, and the contribution I will be making is about 15-20% of my take home pay.

This is an aggressive amount, but I am hoping that once the account starts to grow, I can reduce my contributions, or adjust my returns, based on other factors, as they come up. For now, I had mentioned that the D-Day for the start of account on Oct 1. I have done some research, and found that ING Direct offers a “no fee” savings account, that will allow us to access our money on a regular basis.

This is an aggressive amount, but I am hoping that once the account starts to grow, I can reduce my contributions, or adjust my returns, based on other factors, as they come up. For now, I had mentioned that the D-Day for the start of account on Oct 1. I have done some research, and found that ING Direct offers a “no fee” savings account, that will allow us to access our money on a regular basis. Posted rates are shown to be 2.40%, and with the amount that we are starting off with, its not enough to open an e-trade account at this time. I’ll give a review on ease of setup of the ING account, closer to the end of the month, when I make the first deposit. We will be looking at opening an e-trade account towards the end of the year, ready to trade in the beginning of 2006. I will also detail the steps to set up an e-trade account, when the time comes. This is where things will get interesting. In the mean time, I will be doing more research, and posting relevant information to what I think will be happening in the markets, and the best way to make the most out of our contributions.

Thanks to all that stop and read this blog. I hope you can gain some insight from it, and even offer some information or ask questions. Feel free to click on the ad links in the sidebar too, as this is another form of revenue that I will be adding to my account. Details on how it all works, will be included in a blog later on.

Up Next Blog – Previous Research that led to Creating this Site

No comments:

Post a Comment