28 September 2005

Investing Knowledge Lesson #1

Keep in mind, that we are looking at gaining as much knowledge on how the market works, what to look for, and how to read the information, in preparation for moving into the world of e-trading going into 2006. When we are looking at potential stock buys, there are 6 major considerations in picking a stock;

1. KNOW THE COMPANIES

Every fund manager agrees that knowing the companies as thoroughly as possible -- a strong grasp of their financials, their products, their suppliers, their managers, and customers -- is key to controlling risk.

2. DIVERSIFY AMONG SECTORS

Individual investors can study correlations and volatility at a free Web site, riskgrades.com (details on how the riskgrades.com site works, and what to look for, will be covered in a future entry). The site assigns each stock a "risk grade" and then one for your portfolio. Ideally, the risk grade of the whole should be less than the average of the parts. One caveat: Risk is always changing, so you need to monitor it. We will be considering a variety of stock holdings in the future, in order to minimize our risk.

3. MARGIN OF SAFETY Value managers have their own form of risk control called the "margin of safety" that's straight out of financial textbooks. They'll buy a stock only at a deep discount to what they perceive is its "intrinsic value," or the price it would fetch in a private acquisition. The idea is to buy at prices so low they have little room to fall.

4. DIVIDENDS Stocks that pay dividends are generally less volatile than ones that don't. For one thing, the cash flow from the dividend cushions the portfolio in bear markets. In addition, many investors who own these stocks hold them for the long term so they can collect their payouts, thus reducing the daily volatility caused by active traders.

5. "ECONOMIC MOATS"

These companies often succeed because they have competitive advantages or "economic moats" that protect their businesses. Stryker, the dominant player in the orthopedic implant industry, is one such “moat”. True, it has patents protecting many of its products from competitors, and patents eventually expire. But what won't change, is the growing ranks of seniors, who are the main customers for Stryker's products.

6. DEFENSIVE TRADING

Many investors would not associate frequent trading with low-risk portfolios. Risk can be kept in check with lots of buying and selling. The idea is to weed out stocks that have hit price targets or have fallen.Here's how the defensive trading works. Nextel was at 15 a share in June, 2003, then hit 26 in December of that year. In June, 2004, the stock dropped 20% on worries about a competing technology. If you decided that the concerns were insignificant, you purchased the stock again at around 21. You could have sold it once more late last year for a 17% gain when news broke that Sprint would be acquiring Nextel.If a company has an ugly earnings report that is not the result of a one-time event, then it’s probably a good idea not to hold onto that stock for above average returns.

These points are critical for future analysis that we will be doing. Happy reading, and as always, feedback is welcome, and if you have a question, feel free to leave a comment.

Up Next Blog – Investing Knowledge Lesson #2

23 September 2005

Previous Research - Great Returns!

In this blog entry, I will outline a few examples which I had been following on paper, to see what could be done…the information will surprise you!

Algoma

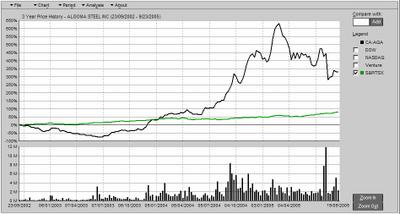

Granted, looking back at what happened with Algoma’s stock, it may seem that its easy to look back and play the “should have” game – that is, look at what the investment could have done, if, if, if….

Algoma had gone through some tough times a few years back. They restructured, and came out of bankruptcy, and if you consider the cash flow intensity of the steel business, you can see that any nominal gains in the price of steel, is going to create more of a cash flow to the business. The chart above shows that after they had restructured, the increase in the share value steadily followed the price of steel on the market. This was primarily due to supply and demand, with the biggest effect on the market being the voracious appetite of China to buy up as much steel as possible, to build their infrastructure. What has helped with the demand for steel, was the fact that China secured the Olympics in 2008, and in addition, China is improving its presence on the world stage with respect to economic development. Granted, Algoma is only a small supplier in the world market, but when the global demands for steel are in the order of millions of tons, all steel companies are affected, with the price of steel soaring to record highs. This market condition has resulted in a few good stock picks in recent years, with Algoma surging ahead to return 600% on stock value in about 1 year. The key connection that had to be made to pick this stock as a winner, was to realize that when the Olympics were awarded to China, eventually their infrastructure had to improve, and you had to look for value in the steel stocks as they came up. In the future, look for India to follow in China’s footsteps, and improving their infrastructure.

Stelco

Some people may disagree with the choice of picking Stelco as a stock with a great return potential. However, given the conditions of the market, and the capability of Stelco to produce steel and make money during the soaring steel prices, while under bankruptcy protection, choosing Stelco under the circumstances would have been a wise choice…

When Stelco entered bankruptcy in January 2004, the conditions under which it filed, was that its pension obligations couldn’t be met if it had to wind up its business. This decision, although at the time was a prudent move on behalf of their management, resulted in the price of Stelco stock to drop. What had helped its return to profitability, was the price of steel on the open market hitting above $700 US a ton (see explanation above under ‘Algoma’) in Q3 2004. As a result, price/earnings ratio for Stelco was extremely low, resulting in a huge value for investors. What gave the investor an opportunity to make money, was the fact that there was belief in the market that Stelco had some value with the profits coming in. This raised the stock price 250% in a short time (approximately 10 months). Granted, it was a gamble that the stock would have had any value after restructuring, but with the in-fighting between creditors, management, and the union, this gave the investor time to make gains in the stock value, before it has hit rock bottom recently, on news that the current restructuring plan before the courts, will wipe out current shareholder value. If you timed it right, you could have made a very good return in 2004-2005 on Stelco stock.

Nortel

Nortel has had its problems in recent years, from being the “darling” of tech stocks, to being plagued with accounting scandals.

Given the fact that its stock value has been beaten to death by accounting errors and restating, Nortel still does a brisk business with over $9 billion in revenue for 2004. In recent years, Nortel has been trimming its work force, and still maintaining a decent revenue, although there have been slight losses in recent years. The above link, gives a profile and analysts’ reviews of Nortel. Recently, they have secured a few contracts to provide their systems for telecommunications in Asia, and given the fact that all the accounting has been fixed up, look for steady increases in shareholder value this year. Q2 2005 reporting, seems to have leveled out the financial problems of Nortel, and looks like it is set to give big returns on value for the next year.

I realize that it is nice to look at the stocks after-the-fact, but the information is out there to realize good gains in stock value. This blog will outline information to make some aggressive picks for our portfolio in the months ahead. As I mentioned before, once we have enough in our savings account, we will open an e-trade stock account, and start to apply our research, and reporting the gains on a regular basis.

Up Next Blog – Some Interesting Background Information

11 September 2005

Starting Off...The Beginning...

One of the things that caught my eye in the news, and particularily the stock market was the review of the top stocks in the country, for annual returns. Every year, there are a handful of stocks that return in excess of 100% in one year. The trick, of course, is to find them! What really got me, was the fact that some stocks, even in the waning industries, like steel, were even returning 600% over a year (Algoma) for 2003-2004. There is no reason that common sense can’t dictate a conservative return of at least 100% over a year, given market performance in some sectors over the past few years.

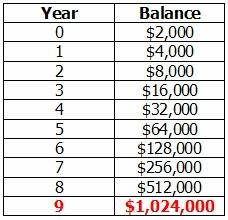

One of the things that caught my eye in the news, and particularily the stock market was the review of the top stocks in the country, for annual returns. Every year, there are a handful of stocks that return in excess of 100% in one year. The trick, of course, is to find them! What really got me, was the fact that some stocks, even in the waning industries, like steel, were even returning 600% over a year (Algoma) for 2003-2004. There is no reason that common sense can’t dictate a conservative return of at least 100% over a year, given market performance in some sectors over the past few years.Granted, there are risks…but the idea is that the money that we save, we know we want to be aggressive with it, and make the most we can for it. For a mere $200 every 2 weeks, there is a cushion in our principal investment, from the table above. If we were to take the total time frame above, and figure what our principal would be over this time, the total is 26 deposits x $200 x 9 years = $46,800. Keep in mind that I will be using my $200 contributions in this blog. Feel free to reduce or increase your contributions accordingly.

Back to my situation. I am a separated male, 42 years old, and my background is in engineering, not finance. I pay child support, I don’t work paid overtime, and the contribution I will be making is about 15-20% of my take home pay.

This is an aggressive amount, but I am hoping that once the account starts to grow, I can reduce my contributions, or adjust my returns, based on other factors, as they come up. For now, I had mentioned that the D-Day for the start of account on Oct 1. I have done some research, and found that ING Direct offers a “no fee” savings account, that will allow us to access our money on a regular basis.

This is an aggressive amount, but I am hoping that once the account starts to grow, I can reduce my contributions, or adjust my returns, based on other factors, as they come up. For now, I had mentioned that the D-Day for the start of account on Oct 1. I have done some research, and found that ING Direct offers a “no fee” savings account, that will allow us to access our money on a regular basis. Posted rates are shown to be 2.40%, and with the amount that we are starting off with, its not enough to open an e-trade account at this time. I’ll give a review on ease of setup of the ING account, closer to the end of the month, when I make the first deposit. We will be looking at opening an e-trade account towards the end of the year, ready to trade in the beginning of 2006. I will also detail the steps to set up an e-trade account, when the time comes. This is where things will get interesting. In the mean time, I will be doing more research, and posting relevant information to what I think will be happening in the markets, and the best way to make the most out of our contributions.

Thanks to all that stop and read this blog. I hope you can gain some insight from it, and even offer some information or ask questions. Feel free to click on the ad links in the sidebar too, as this is another form of revenue that I will be adding to my account. Details on how it all works, will be included in a blog later on.

Up Next Blog – Previous Research that led to Creating this Site

06 September 2005

Introduction

So what’s this about? All the information I have ever seen or come across, has always shown you how to make a million, or that a small fortune has been made, after the fact…that means, it worked for the author, but not necessarily will work for the person that buys the book! Some of the aggressive strategies suggested in these books are time-sensitive.

The basic premise of all “road to financial freedom” or “freedom 55”, is that you must pay yourself first. In order to pay yourself first, consider the account you set up as a regular bill deposit. “Pay to the Order of Me” fund. Through the life of this blog, I will be contributing $200 every 2 weeks to my “account” – this will be my working capital, and I will make various investments, high risk ventures, anything at all (legally), to increase the net worth of my account.

In addition, in order to make this work, we must be disciplined. We have to set limits around gains and losses, and have a goal in mind. It is my intention that I reach a net worth in my account, worth $1,000,000, and I plan to have this net worth before I retire, which, is in 13 years at the earliest.

The changes to the net worth in the account will be reported as total deposits (my regular contribution to the account of $200 every 2 weeks), my gains/losses for the period, and the net return excluding capital gains tax implications, but including fees, costs, etc. associated with any transactions.

So, without further ado, if you would like to watch as money grows, the first deposit will be made on October 1st! A running balance of the account will be kept in the sidebar and the date, in order to track the changes. As time progresses, I will update the blog with notes, and anything that relates to the change in net worth.

Feel free to start your own account, and use any amount you wish to start! If you follow the strategy I lay out, then you will also see the returns I will get.

I will be posting different aspects of my strategy, from what I think will do well in the short term, the long term, speculative markets, and other information that I use to make my decisions. The decisions will be posted before I make them, therefore making this blog, the pre-emptive strike to the increase in net worth!

I will be taking some time to prepare information for this blog over the next few weeks. As I prepare, I will post, and let you know what to do with it, or how it is relevant.

Up Next Blog – Details of my financial situation

Until next time, let’s make a million!

Let's Make a Million - Inaugural Post

I am hoping that all of you that are interested, will comment back on your successes, and together we can make a million!

Keep checking back, as I update this blog with more details!