In this blog entry, I will outline a few examples which I had been following on paper, to see what could be done…the information will surprise you!

Algoma

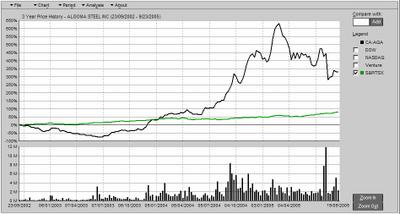

Granted, looking back at what happened with Algoma’s stock, it may seem that its easy to look back and play the “should have” game – that is, look at what the investment could have done, if, if, if….

Algoma had gone through some tough times a few years back. They restructured, and came out of bankruptcy, and if you consider the cash flow intensity of the steel business, you can see that any nominal gains in the price of steel, is going to create more of a cash flow to the business. The chart above shows that after they had restructured, the increase in the share value steadily followed the price of steel on the market. This was primarily due to supply and demand, with the biggest effect on the market being the voracious appetite of China to buy up as much steel as possible, to build their infrastructure. What has helped with the demand for steel, was the fact that China secured the Olympics in 2008, and in addition, China is improving its presence on the world stage with respect to economic development. Granted, Algoma is only a small supplier in the world market, but when the global demands for steel are in the order of millions of tons, all steel companies are affected, with the price of steel soaring to record highs. This market condition has resulted in a few good stock picks in recent years, with Algoma surging ahead to return 600% on stock value in about 1 year. The key connection that had to be made to pick this stock as a winner, was to realize that when the Olympics were awarded to China, eventually their infrastructure had to improve, and you had to look for value in the steel stocks as they came up. In the future, look for India to follow in China’s footsteps, and improving their infrastructure.

Stelco

Some people may disagree with the choice of picking Stelco as a stock with a great return potential. However, given the conditions of the market, and the capability of Stelco to produce steel and make money during the soaring steel prices, while under bankruptcy protection, choosing Stelco under the circumstances would have been a wise choice…

When Stelco entered bankruptcy in January 2004, the conditions under which it filed, was that its pension obligations couldn’t be met if it had to wind up its business. This decision, although at the time was a prudent move on behalf of their management, resulted in the price of Stelco stock to drop. What had helped its return to profitability, was the price of steel on the open market hitting above $700 US a ton (see explanation above under ‘Algoma’) in Q3 2004. As a result, price/earnings ratio for Stelco was extremely low, resulting in a huge value for investors. What gave the investor an opportunity to make money, was the fact that there was belief in the market that Stelco had some value with the profits coming in. This raised the stock price 250% in a short time (approximately 10 months). Granted, it was a gamble that the stock would have had any value after restructuring, but with the in-fighting between creditors, management, and the union, this gave the investor time to make gains in the stock value, before it has hit rock bottom recently, on news that the current restructuring plan before the courts, will wipe out current shareholder value. If you timed it right, you could have made a very good return in 2004-2005 on Stelco stock.

Nortel

Nortel has had its problems in recent years, from being the “darling” of tech stocks, to being plagued with accounting scandals.

Given the fact that its stock value has been beaten to death by accounting errors and restating, Nortel still does a brisk business with over $9 billion in revenue for 2004. In recent years, Nortel has been trimming its work force, and still maintaining a decent revenue, although there have been slight losses in recent years. The above link, gives a profile and analysts’ reviews of Nortel. Recently, they have secured a few contracts to provide their systems for telecommunications in Asia, and given the fact that all the accounting has been fixed up, look for steady increases in shareholder value this year. Q2 2005 reporting, seems to have leveled out the financial problems of Nortel, and looks like it is set to give big returns on value for the next year.

I realize that it is nice to look at the stocks after-the-fact, but the information is out there to realize good gains in stock value. This blog will outline information to make some aggressive picks for our portfolio in the months ahead. As I mentioned before, once we have enough in our savings account, we will open an e-trade stock account, and start to apply our research, and reporting the gains on a regular basis.

Up Next Blog – Some Interesting Background Information

No comments:

Post a Comment