There has been alot of action around Dofasco and Arcelor these days. It would seem that steel stocks are in play, for consolidation of the industry. Given the fact Mittal has made a hostile bid for Arcelor, size doesn't seem to matter. Given that, here are a couple of good buys based on what I have seen;

Corus Group - A marriage of British Steel and Hoogovens, the company has had its share of problems while the bugs were being worked out. Although they still have some fundamental problems, with the current wave of consolidation, Corus looks like it could be a target for someone like Mittal. The question is whether Nippon Steel, being 3rd ranked overall, will they stay there, or will they go on a buying binge? I think news that Corus is being stalked might come out in the 6 months. Worth looking into.

AK Steel - This is a quandry. With the recent results from Nucor, showing an 11% increase over last year, AK should be doing better. I figure AK will go down lower in the next 6 months, based on steel price outlook, and with the Big 3 auto companies cutting back, AK will be hardpressed to show good results. However, with Mittal's style of picking up bargains, I figure the stock will drop mid 2006, and look for someone to come in and steal AK. If the Mittal/Arcelor bid is unsuccessful, then Mittal will turn his sights to some other commodity steelmaker - AK is strip, but Mittal may not be able to pass up a bargain. Auto business should pick up late 2006, and AK might be able to scoop some profits.

I have been lax in writing this blog recently. I will be catching up on some specific financial news this week, and get caught up with the action in the market. I'll also have some comments on the stocks on my watchlist. Stay tuned.

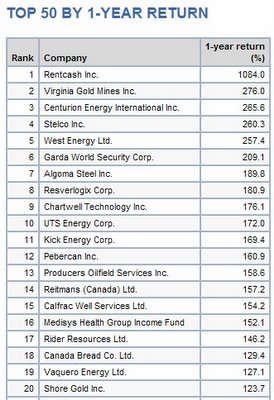

I pulled off the breakdown by large, mid, small cap returns;

I pulled off the breakdown by large, mid, small cap returns;